The world in battery markets

To give you an ample understanding of how batteries are quite literally fuelling the power market of the future in different countries, we invited qualified speakers from some of our partner companies to share their exclusive insights. In this article, we are examining battery markets in Belgium and France as well as the differences in revenue streams with TotalEnergies.

What France and Belgium have in common

The main revenue stream for batteries in both France and Belgium is ancillary services, specifically FCR and aFRR, where assets make money by providing capacity to the TSO, which is then activated as needed. Batteries capture price spreads between charging cycles in the spot, intraday and imbalance energy markets. For optimization, the capacity of the battery must be arbitrated, meaning charged outside of peak hours and stored for use between the markets during periods of high demand.

How the French and Belgian markets differ

FCR market

France and Belgium both participate in the same daily auction – FCR Cooperation, which other European countries such as Austria, Germany, Switzerland and the Netherlands go to as well – but the dynamic in the price formation is quite different. France has a lot of offers at low prices with an average of 89€/MW/4hr in 2022 and decouples from the European auction around 10% of the time. Belgium decouples from the European auction 40% of the time because there is a shortage of low-tariff local offers, so it clears at a higher price to contract capacity domestically. The average price in 2022 was 127€/MW/4hr. Another big difference between France and Belgium is the duration of the battery energy reserve, with 15 and 25 minutes, respectively. This means a disparity arises between the capacities that can be certified for FCR from the same asset installation depending on where it is located.

aFRR market

While this market is only in its opening stages in France, it is already fully liberalized in Belgium, where capacity is procured via daily auction, and energy gets activated by a national merit order with 15-minute-interval price clearings as the market is currently not connected to the rest of Europe through PICASSO (Platform for the International Coordination of Automated Frequency Restoration and Stable System Operation). In France, capacity is contracted by obligation at fixed prices, and energy is activated by a national signal at spot prices until the new market environment launches. In order for a battery to be able to ensure continuous service in capacity and energy markets, the SoC management power assumes a 2-hour energy stock for France and 1.15 hours for Belgium.

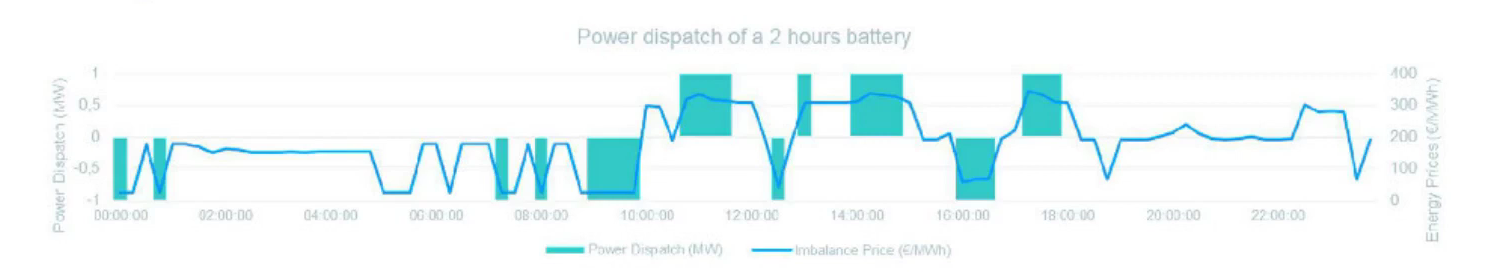

Spot, intraday and imbalance markets

Batteries with more than 2 hours of energy stock have favorable opportunities as the idea is to detect price spreads during the day so that larger spreads can be secured with more energy. The spot market functions similarly in France and Belgium, with grid tariffs posing the only significant distinction. While batteries are exempt in Belgium, France imposes taxes on energy consumption (approx. 14€/MWh), which reduces your revenue cut. The balancing market meanwhile works differently for the countries as the Belgian TSO publishes prices every minute to incentivize market participants to engage in reactive and gridsupportive balancing practices, thus enabling imbalance chasing for the battery. France issues prices 30 minutes after delivery, and the balancing is handled by the TSO directly. Due to this lack of transparency, price spreads are hard to catch on the French market (2022 average imbalance spread 327€/MWh), while in Belgium (2022 average imbalance spread 626€/MWh), the reverse is the case.

More storage equals less volatility

Summing up, the French market is attractive because of its size and profit-building opportunities. At the same time, it suffers from underdeveloped ancillary services and a delayed introduction of aFRR, which makes volatility hard to capture. In Belgium, you have the more or less opposite situation of a small market that is prone to saturation but encompasses fully liberalized ancillary services and high volatility on imbalance markets due to the high price transparency.

French grid-scale battery storage systems are expected to triple by 2030. This would lower both the market volatility and cannibalization risk, whereby too many renewable sources generate too much energy at the same time, causing wholesale electricity prices to drop. For Belgium, Energy Storage News deduces a possible shift towards heavier cycling activities, including capacity provision and energy trading, from plans for the deployment of longer-duration systems. The volumes of battery projects France and Belgium have in their pipelines make them both exciting European markets to watch in the upcoming years.

Looking for more convertible insights?

Follow us on LinkedIn to stay on top of the latest developments in the energy revolution.