Revenue models for battery systems

As the buildout of renewable energy sources progresses, more battery systems are commissioned to capture their flexibility. Project developers and investors encounter a variety of financing structures in this pursuit, each with unique risk and revenue profiles. These revenue strategies determine the bankability and economic feasibility of a BESS (battery energy storage system) use case and range from high-risk, high-reward fully merchant setups to variable floor pricing arrangements to reliable tolling agreements. In special circumstances, hybrid options exist as well. This article examines the nuances of these models to help you navigate the fine line between revenue security and risk management.

Tolling for battery storage

A battery tolling agreement is a contract between an asset owner (toller) and an optimizer that combines revenue stability with risk mitigation. Tolling agreements for BESS grant the asset owner a pre-defined sum of guaranteed revenue, independent of the commercial result achieved by the optimizer, who, in exchange, has the right to utilize the asset’s capacity in the markets as desired and put limitations on the toller.

This is a convenient setup for the asset owner, as it generates fixed revenue, while the risk passes to the toll provider, who must pay the tolling fee even if the asset underperforms commercially. The toller is responsible for the technical setup and all administrative aspects and must guarantee asset availability. Meanwhile, the authority over asset use transfers to the toll provider along with the risk. Battery tolling agreements have neither upside nor downside potential and best suit those who seek a safety net with reliable revenues.

A toll proposal is feasible only if battery specifications and warranty terms are defined and available, as these have a major impact on the tolling scope. Other parameters with significant impact include asset COD (Commercial Operation Date), toll duration, and planned asset availability. Customers are advised to exercise caution with tolling proposals not based on specific data. A very high initial toll value may be misleading and out of context, as it could decrease considerably in the negotiations once asset specifications are clarified.

For all example revenue scenarios, please note that actual stipulations can vary depending on the project.

Revenue scenarios for BESS tolling agreements

| |

scenario #1

battery underperforms

|

scenario #2

battery 'overperforms'

|

| contracted tolling fee |

120k |

120k |

| generated revenue |

70k |

270k |

| asset owner earnings |

120k |

120k |

Fully merchant batteries

In a fully merchant setup, your BESS is exposed to the full downside and the full upside potential. If the battery performs well commercially, this model captures the highest returns, but it features no protection against loss if the asset’s performance is affected by unfavorable market conditions. The high-risk profile of the fully merchant strategy is reflected in the client’s proportionally higher revenue share.

Revenue scenarios for fully merchant batteries

| |

scenario #1 |

scenario #2 |

| contracted revenue split |

90:10 |

90:10 |

| generated revenue |

70k |

270k |

| asset owner earnings |

63k |

243k |

Floor price for BESS, with and without cap

A floor price is the minimum revenue an asset owner makes when using the optimization service of an RTM (route-to-market) provider. This amount is typically contractually fixed but can be variable in certain scenarios. The guaranteed revenue is lower than in a tolling agreement because the asset owner maintains the upside potential, while the optimizer assumes the main risk. The guaranteed minimum revenue can increase depending on the asset’s trading outcome and the contractually fixed revenue split. Floor prices might be capped, meaning the upside potential is limited to a certain amount.

Revenue scenarios for BESS floor price without cap

| |

scenario #1

battery underperforms

|

scenario #2

battery 'overperforms'

|

| contracted floor |

80k |

80k |

| contracted revenue split |

80:20 |

80:20 |

| generated revenue |

70k |

270k |

| asset owner earnings |

80k (the floor) |

216k (the 80% share) |

Revenue scenarios for BESS floor price with cap

| |

scenario #1

the battery underperforms

|

scenario #2

the battery performs under cap range

|

scenario #3

the battery performs over cap range

|

| contracted floor |

80k |

80k |

80k |

| contracted revenue split |

85:15 |

85:15 |

85:15 |

| contracted cap |

130k |

130k |

130k |

| generated revenue |

70k |

120k |

270k |

| asset owner earnings |

80k (the floor) |

102k (the 85% share) |

130k (the cap) |

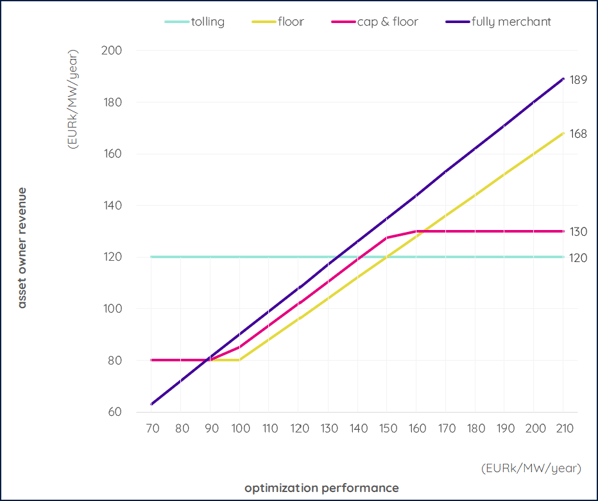

Revenue scenarios for all models with varying optimization results for 1-hour BESS

Tolling, fully merchant, and floor: an overview

| |

tolling

provides guaranteed and plannable revenues for stable project returns

|

fully merchant

allows to fully capture upside and maximize project returns

|

floor without cap

allows full upside participation with downside protection

|

floor with cap

allows efficient upside participation with downside protection

|

| transparency |

n/a |

full transparency |

full transparency |

full transparency |

| downside protection |

full |

n/a |

floor |

floor |

| upside potential |

n/a |

unlimited |

unlimited |

capped |

| guarantee provision |

included |

n/a |

revenue share above floor |

optimized revenue share between floor and cap |

| risk profile |

low |

exposed |

low |

low |

| optimization fee |

included |

share from total revenue |

share from total revenue |

revenue share up to cap |

Hybrid BESS revenue models

If BESS and optimization parameters allow, a hybrid strategy could be applied to your use case. In a hybrid setup, the battery capacity is segmented and individually contracted. For example, a 10 MW battery can have half its capacity tolled and the other half fully merchant (with or without floor, with or without cap). The intention of this division is diversification. It caters to asset owners interested in merging varying risk and revenue profiles. As hybrid models are more complex to implement than standardized revenue forms, their qualification criteria are accordingly selective.

Which revenue strategy suits your battery project?

Informed BESS investment decisions require an understanding of available revenue models. Between tolling, fully merchant, floor, and hybrid strategies, project compatibility varies. Tolling offers plannable revenue and complete downside protection but lacks scalability. The fully merchant model has unlimited revenue potential but is mercilessly exposed to market volatility. Floor prices exhibit a significantly lower revenue split but provide a certain degree of revenue security with the added benefits of downside protection and upside potential. Hybrid options cannot be generalized – they are highly individual and must be assessed on a case-by-case basis.

Due to the dynamic nature of the power market, it is advisable to future-proof BESS business cases for maximum revenue security. This crucial step helps secure project financing from the bank. Currently, the four most common metrics used for revenue assessment are bankable forecasts, backtests, battery index, and portfolio performance. These serve different purposes and give you an idea of a battery's earning potential, which is ultimately determined by your commercial strategy. In summary, your revenue model should be a sustainable compromise between your revenue expectations and risk appetite.

Are you interested in BESS optimization but struggle with financing?