Development, aggregation and marketization of VPPs

Significant growth is expected globally for distributed energy generation, and virtual power plants (VPPs) are crucial tools in helping decentralized energy resources (DERs) participate effectively in the power markets. This article presents valuable insights from various front liners in the VPP space to illustrate the intricacies, challenges and opportunities of this fascinating technology.

Historically speaking, energy systems have always reflected a fairly centralized structure and, for the most part, continue to do so. However, the rapid growth of renewable generators calls for a more distributed approach as they can be installed at small scales, close to points of consumption, and made flexible in combination with a storage device. However, the increasing penetration of DERs into the electricity grid doesn’t come without problems. Their unreliable nature causes fluctuations and irregularities, making it difficult to manage supply and demand problems. This is where virtual power plants come in. Grid balancing issues are solved by pooling power production into a smart umbrella unit with individually controllable components. What makes this master hub virtual, simply put, is the lack of a physical location. While the assets forming the VPP do have actual installation sites, the master hub from which they are piloted exists only in the form of digital software that aggregates, coordinates and optimizes the individual production stations.

The virtuality of the technology is one of its biggest selling points. VPPs can grow without adding physical space to existing sites – all they need is a compatible asset in a different location. “Grid-scale flexibility will only solve short-term needs – that’s why our decarbonized future must be built around a decentralized energy system. Virtual power plants allow assets of any type and size to aggregate and scale endlessly for grid support on all levels,” enspired CGO Jürgen Pfalzer weighs in.

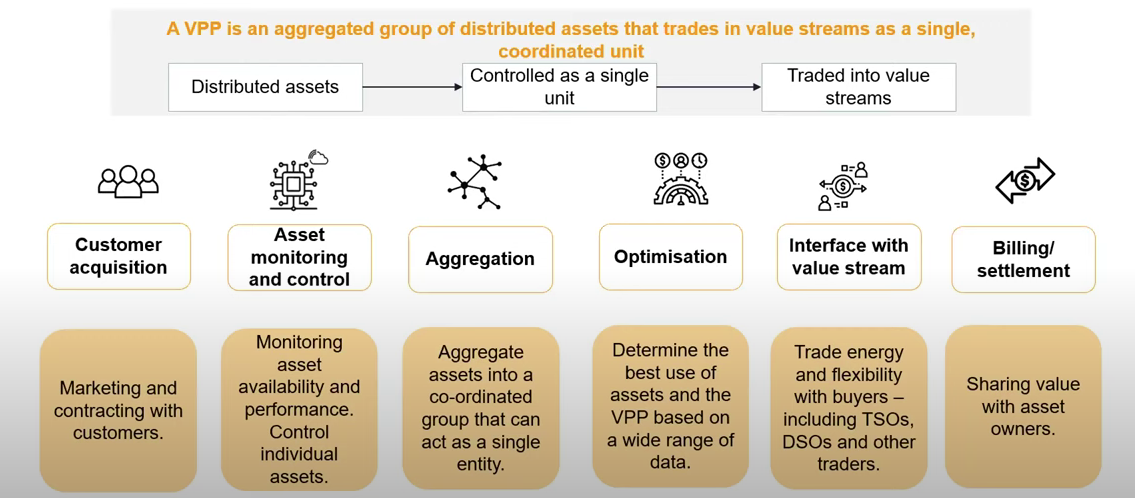

Virtual power plants must function on three levels to be successful: aggregation, coordination and, finally, trading. The diversity of the VPP structure allows for a very broad set of value streams that may be inaccessible to individual assets. Tapping into the right markets at the right time is of the essence for effective monetization.

Every VPP deserves a battery

While there is a point to be made about VPPs not relying on battery energy storage systems (BESS) to function, there is not a single benefit in excluding them, monetary or otherwise. The concept of a VPP is closely related to that of demand response. It provides grid-stabilizing flexibility as well as grid-relieving curtailments. In the first scenario, which is one of low supply and congestion, assets dispatch energy or refrain from consuming it. In the second event, which is one of excess supply, they curb production. A storage architecture heightens this effect many times over, turning virtual power plants into complete, solid, and reliable distribution networks. Intrasystem benefits from a battery-coupled setup include:

- lower energy costs through strategic absorption, generation, and storage patterns that exploit price fluctuations

- added flexibility for power production within the VPP

- improved reactivity to supply and demand situations through internal coordination of energy utilization

- strengthened energy independence with access to backup power during outages

How VPPs are resurfacing the energy landscape

On the commercial front, we have arrived at a stage that incorporates value stacking by expelling VPP assets into the wholesale market based on forecasting, monitoring and optimization techniques. Grouping flexibility from a range of residential, commercial and industrial assets goes hand in hand with the response element of identifying and playing into the most suitable markets. “This evolvement shows that the term VPP is increasingly used to describe flexibility, storage and demand response rather than an aggregation of inflexible renewable generation,” Lucy Murley, Flexibility Research Manager at LCP Delta, elaborates. In Europe, many mergers are forming between separate entities with specialized competencies to cover the entire spectrum of the VPP construct as shown below.

Image source: LCP Delta

Interfacing with value streams is also important for expanding into markets other than the base country. An aggregator or service provider can have everything from customer acquisition to the TSO relationship perfectly in place in their core country, but when trying to enter a new market, local partners are critical for success. For example, a German player with years of experience and a profound understanding of the domestic market can access the Dutch market much more easily by taking this expertise into a partnership with a local trading or route-to-market provider.

The challenges VPPs face and how to solve them

The interoperability of virtual power plants is one of their biggest selling points, but from a control perspective, it of course does not come without problems as there are different technical specifications, communication protocols and regulatory standards to consider. The bigger a VPP grows, the more complex the data and management process becomes. IT security must also be kept in mind as digital systems and communication networks are exposed to cyber threats. Due to the fragmented nature of the technology, concrete regulatory measures that inhibit VPP market participation are difficult to pinpoint, but the biggest roadblock arguably comes from long-term payment risks associated with long-term contracts. Granting a warranty would help circumvent this obstacle, but at the time of writing, no such regulation exists. Overall, VPPs face relatively intransparent market conditions, which engenders uncertainty, hesitation and risk premiums.

Ensuring the financial viability of VPPs and reducing their vulnerability to cyberattacks requires robust management systems and secure data transmission with integrated authentication and encryption mechanisms. Moreover, industry stakeholders must make regulatory bodies aware of the changes required to create a more supportive and less risky environment for VPP market participation.

Virtual power plants in real-world environments

A remote piece of land in Scotland’s Inner Hebrides displays an impressive application of a virtual power plant. The 30 sq km island of Eigg has become independent from the national grid, extracting electricity from an aggregation of local assets including solar panels, wind turbines and hydro stations instead. Excess capacity is stored in battery systems for backup power. The small Scottish isle is a model region for energy self-sufficiency. Thanks to the technology’s virtuality, VPPs are not confined by geographical limits or site dimensions, which shows that the example from Scotland can be magnified by deploying as many industrial and residential assets for aggregation as possible. Watch a short film about the intricacies of the infrastructure here.

The Isle of Eigg in the Inner Hebrides off the north-west coast of Scotland, UK

VPPs are the conventional power plants of the future

Virtual power plants are becoming increasingly superior to conventional power plants in terms of operational flexibility, grid support, energy management, demand response faculties, renewable and distributed asset integration, decentralized market approach and, of course, scalability. These attributes make VPPs ideally suited for our evolving energy landscape, where renewability and electrification are the main objectives. More research and empirical confrontation with the topic is needed to encourage additional investments into the technology and to incentivize the modification of obstructive market policies. Undoubtedly, the methodology behind a virtual power plant is quite complex and requires diligent maintenance, but the end goal of a VPP is nonetheless to simplify processes and minimize this complexity for customers and asset holders so that the flexible energy system of the future can develop.