From ancillary-only to cross-market optimization

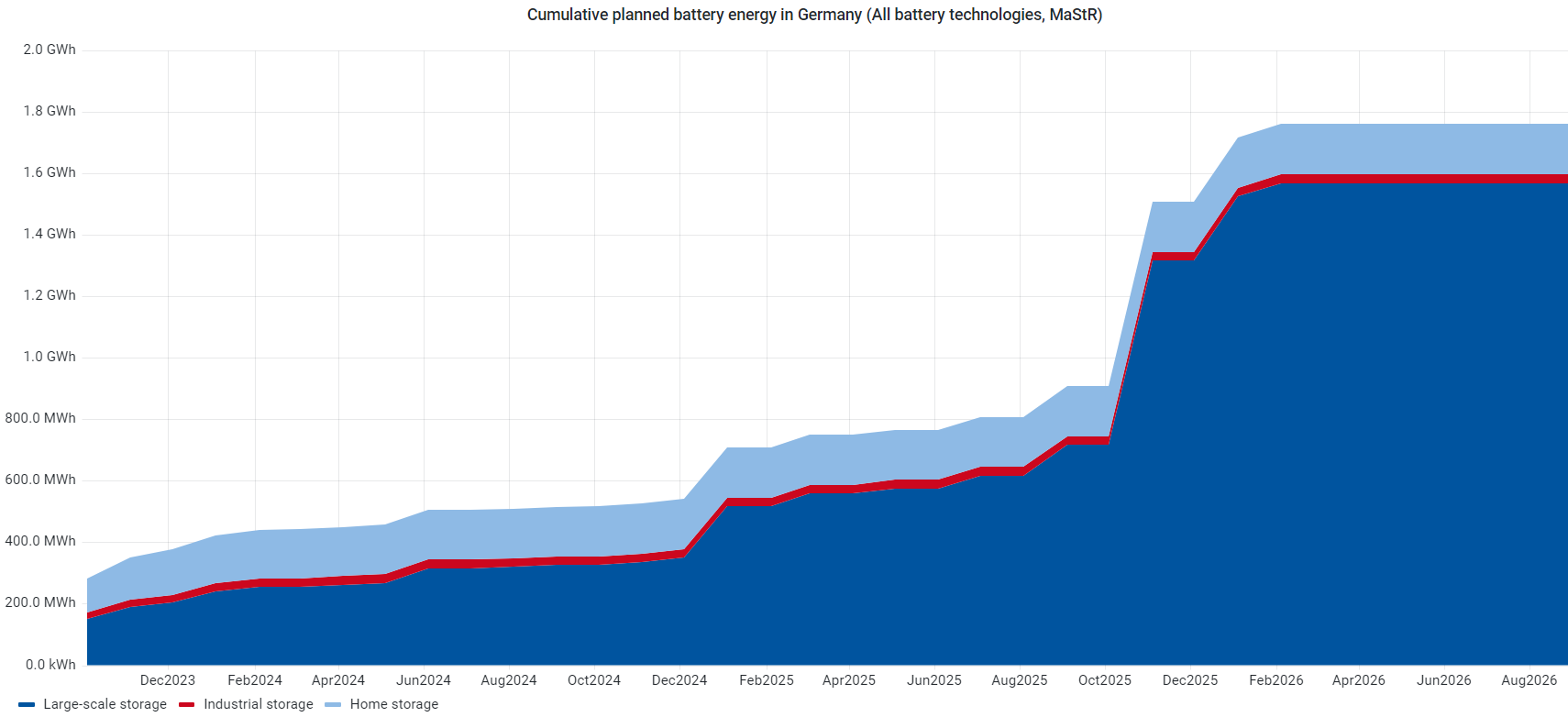

In another visit to one of the world's biggest battery markets, we are investigating Germany together with local player Entelios. Detailing the shift from ancillary-services-only to cross-market optimization, the article also illustrates how warranty terms are affected. Germany has ambitious plans to ramp up battery storage capacity in the upcoming years, which opens more opportunities for value stacking and revenue diversification.

Source: RWTH Aachen

Market developments

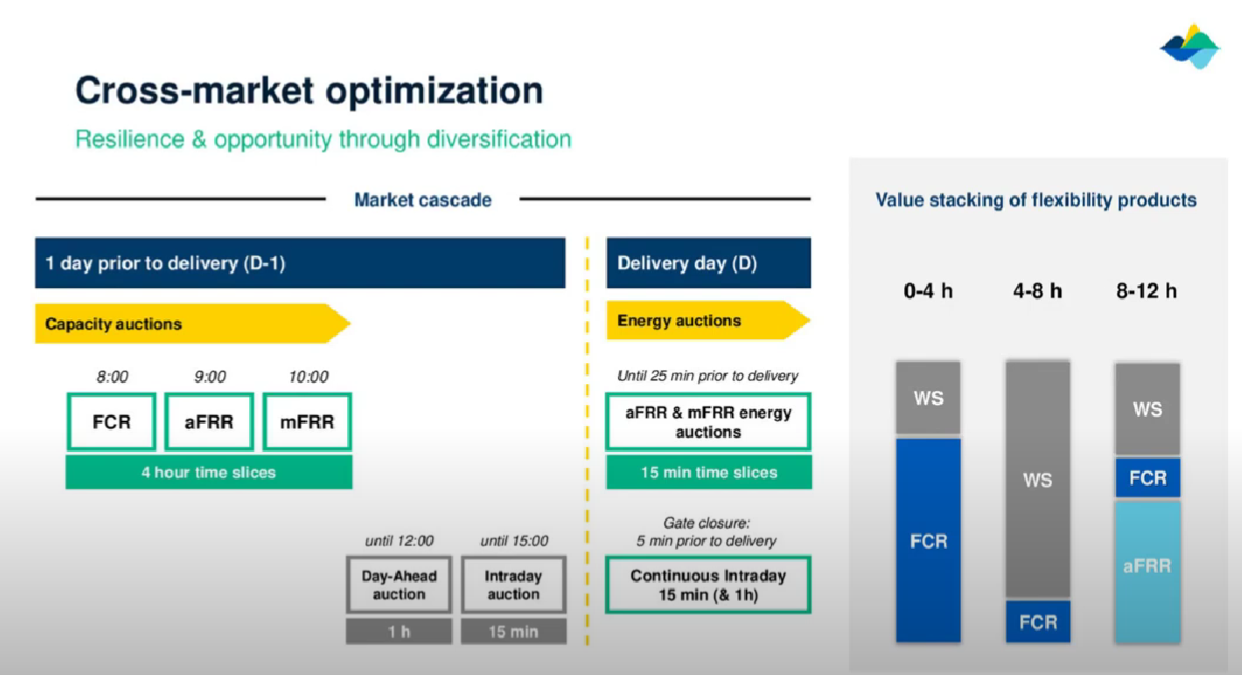

Since 2019, the German market design has matured in granularity and range of opportunities for BESS. The FCR auction structure saw a switch from weekly to daily and then to a 4-hour time slice, effectuating shorter and more frequent bidding and contracting periods for FCR services. Moreover, pay-as-clear pricing was introduced to move away from participants being paid or charged according to prefixed rates that overrule the actual market outcome. The 15-minute criteria for settlement intervals replaced its 30-minute predecessor, allowing for greater temporal precision and responsiveness in marketing activities.

The aFRR market in Germany

aFRR introduced an energy auction next to the separate capacity auction, and eventually, the energy auction was reduced to 15-minute time slices, increasing the granularity in both markets. There was a surge in storage system installations due to the increase in marketing opportunities for batteries and the expansion of renewable generation. In the past, batteries had more power than capacity, and this power couldn’t be harnessed, resulting in high recharging costs. The solution was to combine them with other assets such as backup generators or power-to-heat in order to have more range and reduce costs. Today, the situation is quite different. With opportunities available in wholesales and ancillary services, complexities have shifted to cross-market optimization, and diversification is important to secure profitability and resilience. In practice, diversification starts with ancillary services.

Battery auction timelines

1 day prior to delivery

Capacity auction

- Conducted in 4-hour time slices at set intervals –> 8:00 for FCR, 9:00 for aFRR, 10:00 for mFRR

Day-ahead auction

- Takes place until 12:00 for a 1-hour delivery period

- Enables market participants to trade electricity for the following day

Intraday auction

- Conducted until 15:00 in 15-minute intervals

- Enables market participants to trade closer to delivery time

Same day as delivery

Energy auction

- Covers aFRR and mFRR with 15-minute time slices

- Occurs up until 25 minutes before delivery

Continuous intraday

- Enables trading with two time slices of 15 minutes and 1 hour, respectively

- Occurs up until 5 minutes before delivery

Source: Auction timelines and battery revenue stacking opportunities illustrated by entelios

Revenue stacking: an example

This new market design and the many battery projects in the global pipeline engender numerous options for selling flexibility products. Based on appropriate data evaluation, your strategic value stacking scenario for a 24-hour period could look as follows:

- In the capacity auction one day before delivery, you place a bid for the 0-4-hour interval (from midnight to 4 am), allocating 20% of your battery capacity to wholesales and 80% to FCR

- The 4-8-hour interval (from 4-8 am) favors a 90:10 split into wholesales and FCR, respectively

- aFRR looks promising so you go for a 30:10:60 division into wholesales, FCR and aFRR for the 8-12-hour interval (from 8 am to 12 pm)

The remaining three 4-hour intervals might repeat the pattern of the first 12 hours or reflect a completely different capacity distribution. Reaching the financial optimum depends on adequate backtesting and accurate forecasting to make sure your battery does not sit idle. For comparison, FCR in Germany has 600-700 MW and aFRR almost 4GW, meaning more volume is being put into the latter. This creates valuable marketing opportunities for asset owners. You can go into aFRR, save some cycles and then use them later on in the wholesale market.

Implications on warranty conditions

The optimization scope in the cross-market approach is determined by the warranty terms of a battery system. Individual warranty conditions play a crucial role in revenue diversification, optimization and long-term profit. Opportunities here lie in challenging manufacturers to address asset details such as cooling, thermal load and load patterns. Studying these factors gives insight into BESS performance characteristics and demonstrates improvements needed in the design to ensure longevity. Past structures would not have supported the branching out across relevant markets.

Then and now

- past: 1-hr batteries with use cases peak shaving and FCR

- now: 2-hr batteries with use cases peak shaving, FCR, wholesale+ and aFRR+

- future: 3-hr batteries with use cases peak shaving, FCR, wholesale++, aFRR++

These technological developments bring about multiple new marketing opportunities, resulting in more revenue and, ultimately, more profit. Learn how to maximize earnings from your battery energy storage system here. If you're interested in more battery markets, check out the United States, Belgium and France.

Looking for more convertible insights?

Follow us on LinkedIn to stay on top of the latest developments in the energy revolution.