Let’s stop failing climate targets. They aren’t too ambitious.

When 195 nations put their signature under the Paris Accords in 2016, a historical landmark for the survival of the planet was forged. For the first time on record, we had a formal contract binding the world’s most powerful stakeholders to the intensification of their emission-cutting efforts. The journey since has gone everywhere except according to plan. Given the fraught state of global affairs, it comes as no surprise that the European Union, along with the other signatories, is struggling to meet the climate goals set for 2030. Equally unsurprising is the fact that the world’s reliance on fossil fuels is still the main contributor to this environmental disaster we are catapulting into. In order to cultivate a more positive outlook for the 2050 net zero goals, the time to promote, act and innovate on a unified level is now, starting with the flexibilization of the power grid to facilitate the transition from conventional to renewable energy sources.

One such initiative is the newly launched European Hydropower Alliance. A joint research program of the EERA (European Energy Research Alliance), it backs the climate-oriented interests of the EU, representing organizations with a combined hydropower capacity of over 110 GW. The claim that hydropower is a key driver in the establishment of a clean energy system is substantiated by a number of ecologically and economically valuable factors:

- affordable cost

- water management

- flood and drought control

- greenhouse-gas-less production

- scaleable storage and flexibility

- security of independent supply

- local availability of components for plant constructions

- intermittency compensation for solar and wind

Why batteries are the backbone of a flexible energy system

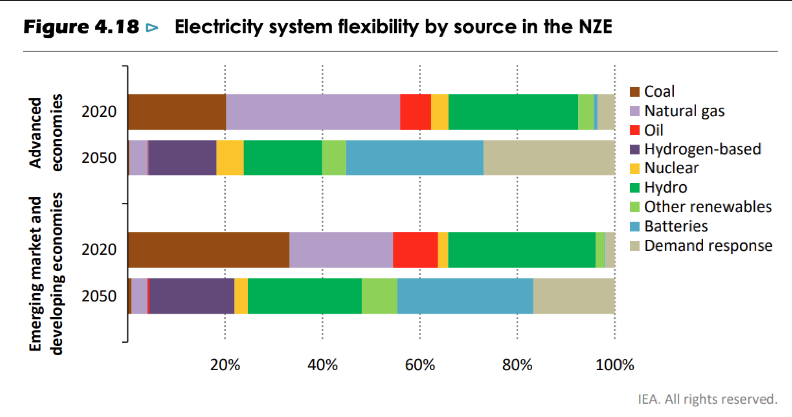

A roadmap by the International Energy Agency (IEA) projects demand response and batteries to become the dominant providers of flexibility by 2050, putting the latter ahead of all other sources. Given their versatile nature, battery systems work in many different configurations, including grid-scale, co-located and behind-the-meter, the last of which will gain significance as small residential assets like photovoltaics, electric vehicles and household batteries become the norm. From a trading perspective, the go-live is easier to transact for batteries than pumped storage because batteries don’t require an enormous piece of land in specific terrain to be installed. Building new pumped storage sites is a colossal undertaking that swallows up a lot of time, money and resources, which means it takes much longer to see a return on investment (ROI). Battery optimization across all relevant markets creates a solidified network of revenue streams and ensures profit reliability.

The trident of flexibility trading

Battery storage, flexible demand and pumped storage form a golden triangle of market optimization, working hand in hand to safeguard a continuous supply of eco-friendly flexibility. Due to the unique ability to arbitrage over time, battery storage gives flexibility a versatile edge that can be harnessed for important grid services such as short-term balancing, frequency regulation and imbalance optimization, enabling the accommodation of more renewables in the electricity mix. enspired specializes in the following battery setups to aid the decarbonization of the industry:

Grid-scale

Deployment of grid-scale battery storage is accelerating at record speed, urging owners to minimize risk by diversifying revenue streams across all relevant markets while respecting specific system layouts, commercial constraints and warranty terms.

Co-located

Co-located batteries are most commonly paired with renewable generation to share grid access. It is essential to assess revenue potentials, access parameters and generation profiles of co-located assets while ensuring PPA conformity and executing earning power with all technical and commercial limitations in mind.

Behind-the-meter

Bound to outgrow all other forms of battery storage, C&I and residential systems allow for a faster payback and rollout than grid-scale or co-located setups. Behind-the-meter assets require a specific aggregation, connectivity and metering concept before they can be positioned on wholesale markets for value maximization of unused capacities.

Demand-side flexibility

Flex demand is very process-based, giving users the option to strategically align energy consumption patterns with the price and availability of electricity. Through active real-time control, usage can be shifted from peak to off-peak hours to score low tariffs and alleviate grid congestion. Typical technologies facilitating this approach include heat storage, power2gas, smart charging and vehicle-to-grid (V2G).

Commercial optimization of flexibility-keeping assets

The worth of the duration and the volume pumped storage offers is hard to overstate. We ensure profit stability by going to as many markets as possible, achieving higher spreads than with an ancillary-only approach. We also lower your production costs – our optimization consults historical data in identical conditions to determine the ideal times and price points for pumping water back into the upper reservoir before initiating action. As low prices tend to occur when renewables are the most prevalent, your carbon footprint decreases.

Our demand-side optimization technique is designed to liberalize the way you run charging processes for your assets. Aligning your production with opportune times of the day allows you to be more economical and save costs while easing the grid out of supply and demand problems. For battery storage, we perform cross-market optimization to diversify revenue streams for asset owners while supporting the grid with extra flexibility. The market holds many untapped possibilities for storage systems, and we can exploit them to the fullest by transferring the capacity stuck in ancillary services over to wholesales. How does this look in practice? These verified case studies with our partners give you an in-depth understanding of how our battery optimization tactic translates to concrete use cases.

“Hydro is the greenest storage type we have, but beyond seasonal and grid-stabilizing purposes, it is somewhat underused. The same applies to flexible demand, which has vast potential but largely sits idle. What’s great about the two is that they complement battery storage, and this is a market in which we are observing a lot of positive commotion. Flexibility is a necessary long-term commitment the energy transition can’t function without. Using these assets to bring more of it to the market increases their monetary value while saving emissions in the process, and this is really the kind of thing we put our hearts and souls into here at enspired,” CEO Jürgen Mayerhofer weighs in. “With batteries at the forefront of the flexibility charge, we are fortifying a circular energy system that inches us closer and closer to carbon neutrality. Our 2050 net zero goal doesn’t have to go down in history as another promise that couldn’t be kept.”

Subscribe to our newsletter to stay on top of the latest developments in the energy revolution.