Speaking at the launch of the World Meteorological Organization’s State of the Global Climate 2021 Report in May 2022, United Nations Secretary General Antonió Guterres called for a global coalition on battery storage, acknowledging that storing renewable energy is commonly seen as “the greatest barrier to the clean energy transition.” Indeed, it is only by investing in battery energy storage systems (BESS) and by commissioning large-scale projects that we can propel the growth that will be fundamental to the clean energy transition.

Batteries are not only vital but also very complex, both technically and economically. If you want to make the most of them, you need to know how they work and how you can optimize their performance. It is all the more important when you consider that they are the most expensive single-wearing part of the energy transition.

The technical side

A battery is quite an ingenious device: it can both store energy and release it when necessary, enabling business models that were impossible earlier. By using photovoltaics and a battery system, you can optimize your consumption (i.e., store power for later use), and co-locating battery storage with wind and solar PV can maximize both your production and your profits because it enables you to sell power when prices are higher. Through virtual power plants, you can aggregate household or commercial and industrial (C&I) scale batteries and trade them on short-term power markets. That way, you generate revenue and provide flexibility to the market.

It is understandable that a battery storage owner should try to maximize the potential of the battery by “squeezing” it as optimally as possible. Operating a battery, however, automatically means driving its degradation. Every single operation - or “mission profile,” to use the technical term - puts a strain on it, the stress factors being temperature, the rate of charge or discharge, and the state of charge (SoC - the amount of charge in the cell compared to its nominal capacity in ampere hour) window. This last factor is key because lithium-ion batteries are very sensitive to the SoC window in which they are operated. In addition, there are different lithium-ion technologies, and they vary in terms of how they react.

Counting full charge cycles (i.e., the total energy throughput) with no regard to which stress conditions exist during the energy flow does not give a complete picture of the quality of the device. It’s not unlike the correlation between a person’s age and health. Globally, life expectancy is 73 years, but that doesn’t mean everyone lives to be 73: dietary habits, lifestyle choices, and the amount of stress a person is under are all determining factors.

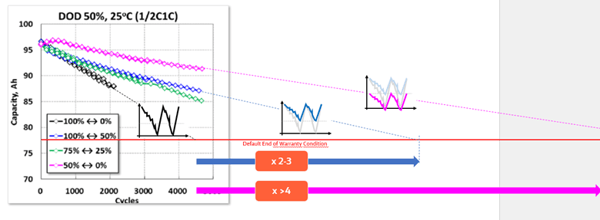

Consider the figure below to see how the performance of a certain battery type can change according to what SoC range it is operated in.

The black line represents an operation in the full range (0-100%), but you can achieve the same total energy throughput with a battery operated in the 50-100% range (i.e., by using a battery that is twice the size) and that can more than double its life cycle. Operating your battery in the 0-50% range can even quadruple it.

By squeezing the battery the way you would a lemon, you might run the risk of overstressing your asset and ruining it - along with the chance of gaining all the revenue your BESS could potentially yield. At the same time, underutilization is just as serious a problem.

Typically, a battery is either bought in its existing condition or, together with the warranty conditions, it is tailored to one particular use case. Either way, there will probably be certain limitations to its operation. If you add to that the fact that, amazingly, owners tend to have no means to independently and continuously monitor stress and battery quality - and, consequently, its remaining useful lifetime - it’s understandable that they are too cautious when using their asset.

Assuming that we can produce batteries sustainably, we could significantly increase their profitability if we knew how to operate them in a way that is economically optimal. That, in turn, would lead to the deployment of more such battery systems, which would give a boost to green energy production and speed up the energy transition. This may sound like a hypothetical situation, but it’s not: we do in fact know how it can be done.

The revenue side

Battery business cases are typically calculated based only on FCR (Frequency Containment Reserve) prices, but those are difficult to forecast because of the cannibalization effect, which results from the fact that a growing number of battery systems are now available for FCR. For years now, FCR prices have tended to fall, and so the risk of financing battery business cases exclusively from FCR prices is increasing. To enable future business cases, the commercial optimization of batteries is crucial. This requires developing a trading strategy that enables you to maximize the revenue your battery storage generates by reaching a balance between profit and battery lifetime. Normally, you might take a more conservative approach to prolonging battery life, but occasionally, when prices are extremely high or low, the profits can exceed the cost of shortening it.

You should consider partnering with a company that handles the commercial optimization (including floor pricing, i.e., a fixed price guaranteed to the asset owner) of your BESS across European day-ahead and intraday markets to ensure a profitable business case and an increase in your revenue. The ideal service provider also takes into account warranty limits, safety, battery degradation, and other technical restrictions (e.g., depth of discharge, state of charge) to maximize the use of your battery storage.

By marketing your battery system across all markets, you increase your profit and reduce the risk of falling FCR prices ruining your business case. Even if more cycles are run as a result of spot market trading than in FCR-only mode, with the right partner you can get the most out of your system with no harm coming to your battery storage.

With volytica and enspired, your BESS is in good hands. Book a meeting with our experts - they’ll be happy to discuss your business case with you.

volytica diagnostics GmbH

As an independent software provider, volytica diagnostics makes the battery as the most expensive part of a vehicle or a storage system transparent. By unlocking valuable information in the field data that continuously accumulates during daily battery operation, they enable their customers to develop more economical battery systems, reduce operational risks and establish second-use concepts. Volytica's technology not only enables live monitoring of batteries, it also offers the possibility to assure the safety and quality of any battery.

Claudius Jehle, CEO volytica diagnostics GmbH