Grid fees in Germany: the sand in the gears of the energy transition

Renewable energy has the potential to lower electricity prices in the long term, but the necessary grid expansion and associated redispatch costs cause complications. Unlike electricity production costs, which can be hedged against, grid fees are more politically controlled and ultimately influenced by the Federal Network Agency (BNA – Bundesnetzagentur). According to EnBW, these grid fees make up a quarter of the retail price and, therefore, deserve similar regulatory attention as electricity costs themselves.

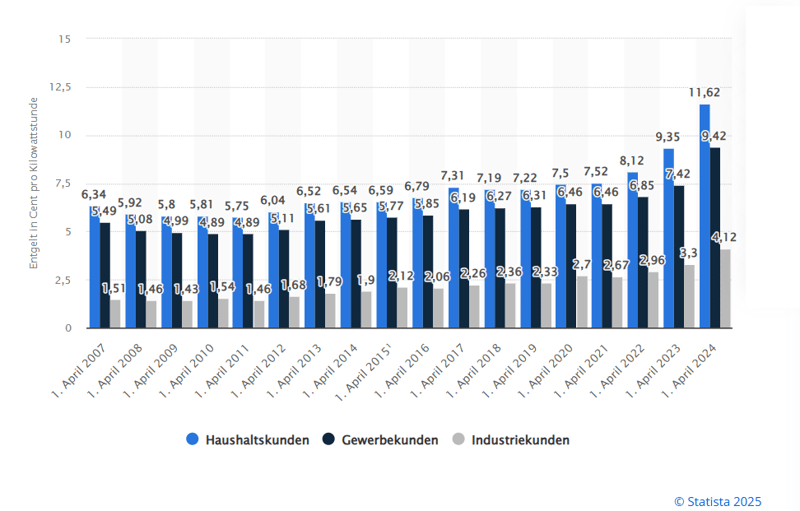

Europe is faced with a daunting challenge: On the one hand, we need to become more competitive, and, at the same time, we must invest more heavily in the infrastructure required to keep up with the new generation structures of renewable energies. The problem is a familiar one in the industry – policymakers, grid operators, and flexibility providers have been working on combatting it for years. €13 billion was invested in grid expansion in 2023, but the Hans Böckler Foundation estimates the annual demand until 2045 at €34 billion. Grid fees have risen by over 50% since 2021, although this varies by region. The years 2022-2024, in particular, prompted industry-wide calls to reform grid fees.

Grid fees for electricity in Germany by customer group from 2007-2024 (expressed in euro cent per KWh)

Source: Statista

In parallel, scientists and flexibility providers have repeatedly pointed out that the incentive outlined in §19-2-1 StromNEV to evenly distribute power consumption of energy-intensive industries hinders the imperative flexibilization of the power system. The storage sector has thus far benefitted from a grid fee exemption, which might no longer apply to installations that start operating in 2029 and after. To ensure continuity, a framework to regulate grid fees in the future must be established now.

The Federal Network Agency BNA: a key stakeholder

With the law “to adapt the energy industry law (EnWG - Energiewirtschaftsgesetz) to EU requirements and to amend other regulations related to energy law,” which was passed in November 2023, Germany has legally and securely implemented the EU directive and equipped the BNA with the authority to issue provisions. It is to be expected that the StromNEV will “no longer be applicable in the foreseeable future as a result.” (source: BNA Eckpunktepapier 2024, page 3)

This law also includes the amendment of §118(6) in the EnWG, which states that storage is exempt from grid fees if feeding power into the grid before August 2029. The BNA is legally entitled to override this law at any time and currently in the process of redesigning incentive regulations – the central refinancing tool for grid operators. One proposed idea is compensating grid operators for energy transition expertise. According to the key point paper cited above, this initiative could cover factors such as grid connection speed and frequency of §14a curtailments (controlled reduction of electricity consumption by flexible loads – e.g. heat pumps or EV charging – to provide grid relief).

All EU member states are encouraged to develop a framework for flexibilized grid connections, formalized in 2024 in Article 6a of the European electricity market design reform directive (source: Directive EU 2024/1711) and subsequently implemented in Article 8a of the EnWG. In the initial stage, this concerns the expansion of grid connections on a voluntary basis; price effects may follow.

What does this mean for the future of battery storage in Germany?

Grid-scale BESS that will be connected to the grid before 2029 have investment security, but what happens next? To projects already in the planning phase? The BNA has reportedly acknowledged the issue and aims to introduce a corresponding revision in 2025. And now it gets really complicated. Batteries are vital, but the entire energy system is built on the premise (besides being grid-dependent) that electricity is not storable. Thus, battery storage lacks its own category and regulatory presence in the context of grid fees in Germany. Following standard logic, batteries are generators when discharging and consumers when charging. And, as we know, consumers pay grid fees. Building on this reasoning, if a stored MWh is transported twice, it must be paid twice. Eventually, this MWh ends up with the consumer – with double the grid fees. We can use canned soup as a comparison here. This product is transported twice as well: first from the manufacturer to the distribution center and from there to the supermarket. The truck completes two trips. For electricity, however, there is no truck, and no charge based on distance but a flat rate per grid level to cover incurred costs. If a storage system causes no to very low grid costs, double charges make very little sense.

Mandating storage grid fees might appear fair on the surface, but since these fees must be earned back, they will ultimately be reflected in the electricity price, meaning carried by the end consumer one way or another. What seems evident is that subjecting storage to grid fees will lead to fewer realized battery projects, limiting their ability to contribute to market optimizations and the energy transition. Right now, the storage industry is experiencing a gold rush. This admittedly implies that storage is a lucrative business, but as capacities ramp up, speed and having a strong marketer will become more important than ever. As we all know, booms are temporary, and early adopters typically remain at the forefront as the market stabilizes.

At certain times, storage systems can exacerbate bottlenecks, and grid fees act as a lever to address this problem. Incentives and restrictions are either location- or time-specific, and in both cases, today’s incentive can turn into tomorrow’s Phyrric victory if the system is too rigid. A certain degree of flexibility can counter this risk, but it also creates investment uncertainty or even a revenue loss significant enough to negate the benefits.

Battery storage is indispensable in a modern power system – they mitigate price spikes, provide inexpensive control reserves and other crucial services. Storage regulations in Germany are currently in a transitional phase with many overlapping processes. The BNA will present preliminary results of the grid free reform for consultation in late spring 2025. It remains to be seen what developments the rest of the year will bring, and how we can evaluate them.

Keep an eye on our LinkedIn for updates on emerging policies, especially as the new political landscape in Germany takes shape.

Do you have questions about the impact of grid fees on BESS monetization?

Our experts can help.