Battery optimization for maximum revenue with minimum degradation

In a new era of optimization, we market batteries for maximum revenue with minimum degradation through cell-specific dispatch profiles.

Power markets and energy trading in Europe: This reference system details market setups and mechanisms in long- and short-term timeframes.

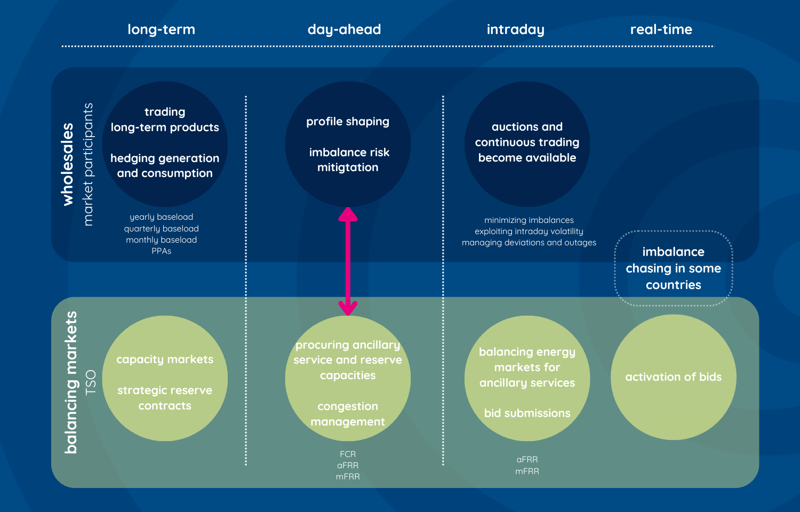

The power market is a complex ecosystem of overlapping and diverging submarkets. It is portrayed and looked at in many different ways, which makes it difficult to provide one true overview. In the trading world, we find it easiest to distinguish the market design in timeframes, participants, and purposes. This article draws up a market map in phases, illustrating long- and short-term timelines from the perspectives of the grid operators on one end and commercial market entities on the other.

All timeframes unfold in the wholesale market, where traders, generators, and retailers operate, and in the balancing market, where the TSO (Transmission System Operator) sources energy from them to maintain a balanced grid. The segments within this umbrella structure are connected by one underlying principle: ensuring network stability. This is what shapes the ever-changing demand and supply situation. What exactly constitutes grid balance?

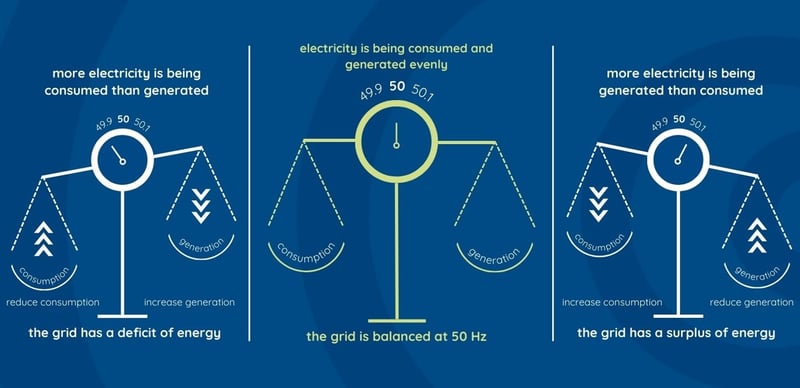

Visualizing grid balance

The grid is considered balanced when electricity is being consumed and generated evenly to reach a steady frequency of 50 Hz. It is the responsibility of the TSO to secure this balance, but fluctuations will inevitably happen. The grid can go out of balance in two ways.

To counter the first scenario, the TSO must see to it that consumption is reduced or that generation is increased. Inversely, the second scenario calls for an increase in consumption or a decrease in generation. The transactions to achieve this 50 Hz balance occur in various energy markets, where participants trade energy products to capture value.

Power market structure in Europe

On the commercial front of the long-term timescale, we have the wholesale market, where retailers, traders, and producers trade long-term products and hedge generation and consumption. How does this work? Typically, market participants sell energy commodities for future delivery at pre-agreed prices and terms.

Let us assume you have a 100 MW power plant, and somebody wants to hedge or buy 10 MW for the delivery year 2027 from you. This means you already locked in some revenue for the future. Since forward markets are not as liquid as their shorter-term counterparts, energy is typically sold in small quantities for yearly, monthly, or quarterly baseloads as well as PPAs and peak loads. Over time, you are building up your position until your power plant is fully or sufficiently hedged but still optimizable in the short-term markets.

Eventually, all market participants arrive at the day-ahead timeframe with a specific position. If you sold 100 MW of your 100 MW power plant, your position is ‘fully hedged’. This is good, but there is always more room to optimize. In case you sold the 100 MW at an average price of 100€/MW, you can try to buy back this capacity at a cheaper rate of, say, 40€/MW if the market develops this way. A crucial factor to consider here is your generation cost. If the power costs 50€/MW to produce, it does not make sense to buy it back for a price of 60€/MW.

Even if you are fully hedged, you can still participate in the day-ahead market or ancillary services to optimize your physical position and generate more value. This process of buying back is not necessarily a strategic decision. If the generation of your plant cannot match the amount you sold, be it due to a heat wave or a technical error, it can happen that you are forced to recover capacity from a third-party market player.

The main market phases on the TSO side are the capacity markets and strategic reserve contracts. Capacity markets are very mature in the UK, while Germany just recently announced the introduction of a full-fledged capacity market, although it is unclear at this point what its exact structure will be. You may encounter the term BRP (Balancing Responsible Party) when studying balancing markets – it refers to the commercial market participants that balance electricity production and consumption to meet system needs at the command of grid operators. In the capacity markets, the TSO financially compensates generators for their ability to provide and maintain a certain level of reliable supply for the grid, separate from what is actually produced and sold.

Capacity markets can provide a secular cash flow, meaning without influence from short-term fluctuations or changes in the market situation. Examples in the UK include the T-1 and T-4 auctions, which procure capacity for 1- and 4-year timeframes, respectively. Battery project developers today can benefit from these markets because already having a guaranteed cash flow for 2028 helps with securing financing from the bank.

Strategic reserve contracts differ from the capacity markets in that the TSO pays generators to keep their power plants open. Such a need occurs when a producer incurs a significant loss and makes the smart financial decision to shut down the plant. Since the TSOs often cannot afford to lose the associated flexible generation, they instead opt to compensate the producers to keep the plant active even if there is no place for its capacity in the market. If a need arises, the TSOs give plant operators the signal to resume generation. The preparation to take a power plant back online can take several weeks.

TSOs, bar very few exceptions, are not allowed on the wholesale market because they have access to sensitive, non-public information that could potentially manipulate market behavior. It is not part of their job description to trade electricity.

In the day-ahead timeframe, traders and generators have a better understanding of how the wholesale market is evolving than in a long-term setting. This helps with risk mitigation. As their generation capabilities and consumption patterns emerge, the gap between the physical and the traded profile is narrowed to a finer granularity, making the market situation easier to assess.

At the same time, market participants can merchandise electricity in ancillary services and control reserve markets, including FCR (Frequency Containment Reserve), aFRR (automatic Frequency Restoration Reserve), and mFRR (manual Frequency Restoration Reserve). In these, the TSO procures reserves to ensure that enough capacity is available for activation in the event of a grid imbalance. The exact day-ahead timeframes are expressed in D units, where D stands for delivery day, D-1 for delivery day minus one, D-7 for delivery day minus 7, and so on.

Balancing needs are becoming increasingly apparent in the day-ahead timeframe, which helps market participants price their services according to the real market value. If you had to submit bids into the aFRR capacity market one year in advance, the cost would be very difficult to calculate and assess. You would be compelled to price substantial risk into the bid, which, in turn, would make it very expensive. Therefore, we have different reserve products with different services and activation times in the short-term settings of FCR, aFRR, and mFRR. The table below gives you an overview of their most important features, using the common internal markets as reference.

| FCR | aFRR capacity | aFRR energy | mFRR capacity | mFRR energy | |

| Hierarchy | primary reserve | secondary reserve | secondary reserve | tertiary reserve | tertiary reserve |

| Purpose |

|

|

|

|

|

| Procurement | local and cross-border | local and cross-border | local and cross-border | local and cross-border | local and cross-border |

| Bid submission | 11 am D-14 to 8 am D-1 | 9 am D-7 to 9 am D-1 | up until 25 minutes before each delivery period | 10 am D-7 to 10 am D-1 | up until 25 minutes before each delivery period |

| Product duration | 4 hours | 4 hours | 15 minutes | 4 hours | 15 minutes |

| Activation method | automated based on frequency deviations | automated based on TSO signal | automated based on TSO signal | manual | manual |

| Pricing system | pay-as-cleared | pay-as-bid | pay-as-cleared and sometimes pay-as-bid | pay-as-bid | pay-as-cleared and sometimes pay-as-bid |

| Common internal market | FCR Cooperation | PICASSO* | MARI* | ||

| Operational member countries | AT, BE, CZ, DK, NL, FR, DE, SI, CH (source) |

|

AT, CZ, DE, IT, NL, BE, GR, DK, LT, SK, BG (source) | AT, CZ, DE, IT, NL, BE, GR, DK, LT, SK, BG (source) |

*PICASSO: Platform for the International Coordination of Automated Frequency Restoration and Stable System Operation

*MARI: Manually Activated Reserves Initiative

These products are independently marketed, but they have an inter-supportive backup function. As system imbalances change, the aFRR reserve is continuously going up or down to cover them. If a problem occurs, for example, a technical issue with a nuclear power plant that prompts an outage of 2000 MWs, the aFRR reserve will be at capacity for an extended period of time. Meanwhile, small routine fluctuations continue to arise, and since the fully activated aFRR cannot keep up with regulating them, compensation is initiated through the mFRR reserve instead. The collective term for aFRR and mFRR is FRR (Frequency Restoration Reserve).

The main difference between aFRR and mFRR is the activation method. mFRR requires manual intervention from grid operators. This means the TSO instructs you to activate your asset on a case-by-case basis. In aFRR, the TSO automatically issues activation signals every few seconds. Effective communication protocols are essential for smooth operation.

In the day-ahead timeframe, it is relatively straightforward to determine how much reserve capacity would be needed to cover the worst-case scenario. To deduce this, the TSO analyses relevant variants such as temperature, renewable output, and demand curve trends for certain days of the week. Based on the historical, stochastic, and probabilistic data in the system, accurate conclusions can be drawn about the FRR capacity needs in the positive or negative direction. The derived volume then goes into the procurement tender.

There is no one established way of ascertaining the required volume. The European guidelines provide pointers rather than an exact calculation method. This is why the TSOs came up with their own methodology, which received approval form the authorities and is now widely in use. The FCR market applies a relatively static calculation method, which has been set in stone for over two decades. In Europe, 3000 MW must be kept in reserve, and this volume is divided proportionally based on each country’s generation. Germany is the biggest country, so it has the biggest FCR share. While the calculation is quite uniform, the way the TSO buys this capacity from the service providers can vary. European countries working together in the FCR Cooperation procure 4-hour products, but countries outside of this common market do not follow the same process.

No such widespread cooperation exists for aFRR capacity procurement, but Germany and Austria implemented a joint auction for 4-hour blocks similar to FCR, whereas the Netherlands has 24-hour products. In addition to the above, grid operators are responsible for congestion management, also referred to as redispatch. This entitles the TSO to override the production plans of generators in the event of congestion or network issues.

Wholesale day-ahead auctions are typically held at midday, and the exchange closes at 12 p.m., bar a few exceptions. The reserve markets are in session earlier, which means capacity might be won that requires long-term positions to be reshaped. If your long-term position does not allow you to provide reserves in the reserve auctions, you must alter your day-ahead position by submitting bids and buying back capacity or selling more of it in the wholesale auction.

In the intraday timeframe, which in system balancing means real-time, options sold to the TSO in the day-ahead auction await activation, and continuous trading becomes available in the wholesale market. Here, market participants manage forecast deviations from their day-ahead schedules, renewable position closings, and outages. If a power plant has an issue and cannot generate hedged positions, this capacity must be bought back. The aim is to minimize imbalances and exploit intraday volatility.

Capacity reserved by the TSO in the day-ahead timeframe cannot be sold on the wholesale market in any of the concurrent or subsequent market phases, regardless of whether this capacity ends up getting activated or not. The TSO compensates you for the availability of FCR, aFRR, and mFRR capacity; activation depends on real-time balancing needs as well as your price. From all the balancing bids by all the sellers, a merit-order list is created for each delivery period, and if the system reflects a real-time balancing need, the TSO starts activating those bids. This means that even if you have the cheapest bid, it might not be activated because there simply isn’t a need for it. If the TSO bought your option in the day-ahead auction, you are obliged to submit bids for the activation, too. In other words, every accepted aFRR capacity bid requires you to place a bid of at least equal value into aFRR energy. If the TSO did not buy your option in day day-ahead timeframe, you can still submit bids for activation in the balancing energy market if you are able to deliver.

In the final market phase, the TSO checks whether there is a real-time need for bids submitted in the intraday energy market and activates them accordingly. The wholesale market is not relevant in the end phase. Some countries, including the Netherlands, Belgium, and the UK, have so-called imbalance markets, whereby imbalances are generated deliberately because the TSO offers compensation for them if they help the system. In other words, if your imbalance is mitigating the imbalance of the entire system, you will receive money for it. Conversely, if your imbalance hurts the system, you will get penalized. This principle applies universally across Europe. The difference is whether you are allowed to chase these imbalances on purpose or not. It would be more accurate to classify imbalance chasing as a revenue stream as it lacks the organized structure that is characteristic of any proper marketplace.

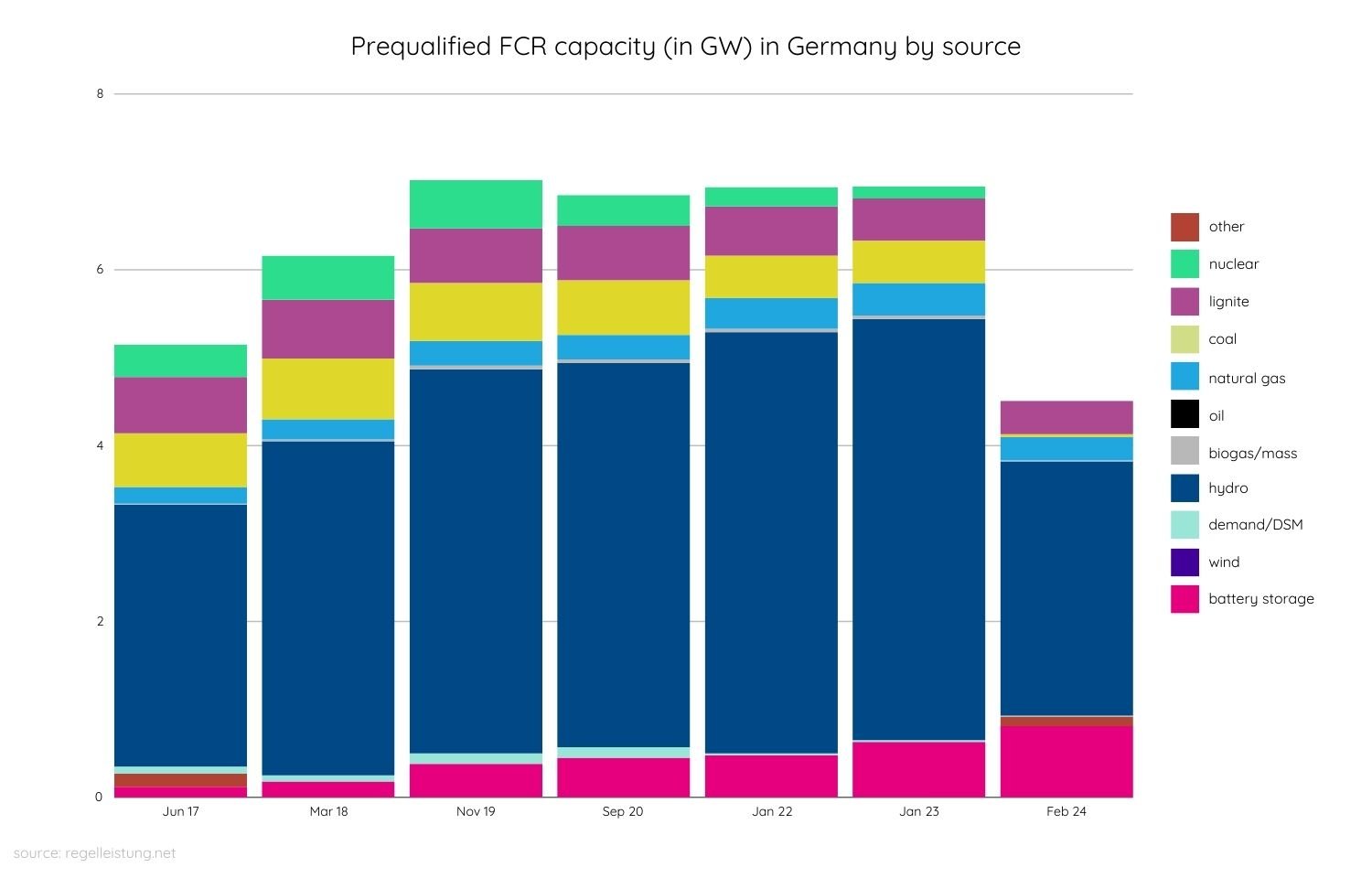

Recent data published by the German grid operators 50Hertz, Amprion, Tennet, and Transnet BW shows that prequalified FCR capacity in 2024 dropped by 35% to 4.5GW, while prequalified aFRR capacity remained steady compared to the previous year.

Prequalified FCR capacity by source in GW between 2017 and 2024 in Germany (source: regelleistung.net).

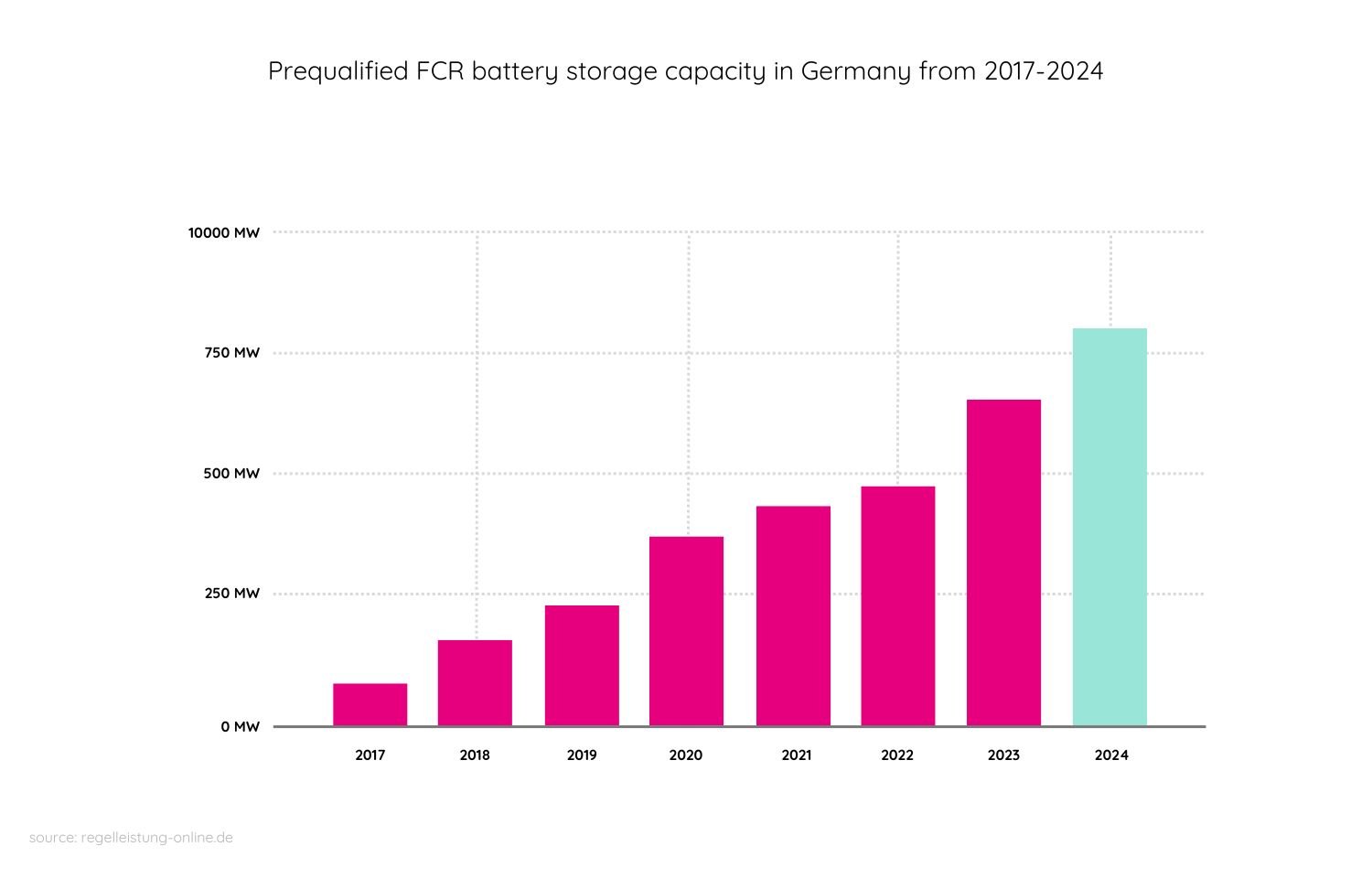

Battery storage capacity continues to grow

The only technology with an increase in FCR capacity is battery storage, which grew by 180 MW in 2024 and covers more than the total demand. This means that batteries will have to move to other markets in order to counteract the cannibalization effect in FCR.

Prequalified FCR storage capacity in MW between 2017 and 2024 in Germany (source: regelleistung.net).

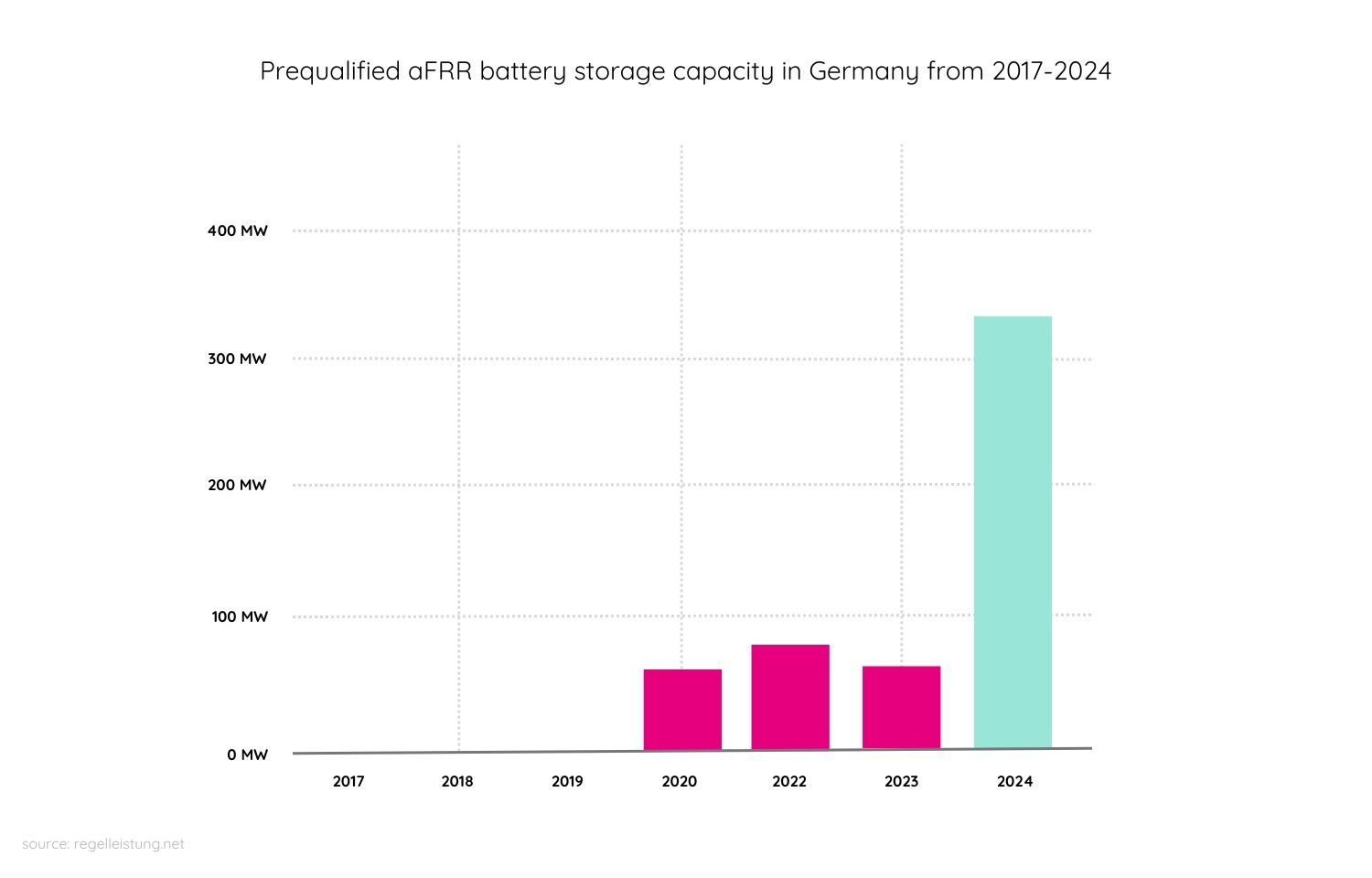

Overall, the prequalified capacity for aFRR in 2024 does not exhibit major divergencies from previous years. What has changed are the capacity sources. Prequalified battery capacity rose from 60 MW to 360 MW – an even higher increase than FCR. These findings highlight the decisive role battery storage plays in the continuous availability and supply of balancing energy.

Prequalified aFRR storage capacity in MW between 2017 and 2024 in Germany (source: regelleistung.net).

Now that you are familiar with the way the energy market works in Europe, you probably wonder how much money you can make by participating in it. The answer depends on how your asset is marketed. If you want to exploit its entire monetary potential, you need to take it fully merchant across all available revenue streams. Do you have a battery or flexibility use case you are thinking of monetizing? Asset optimization is the only future-proof profit strategy for power assets. Let’s optimize yours and outperform industry benchmarks by 40-60%.

Get in touch with our experts to leverage these markets for your business case!

In a new era of optimization, we market batteries for maximum revenue with minimum degradation through cell-specific dispatch profiles.

Conventional thermal power plants remain the backbone of the energy market. What role will they play in a net-zero power market?

5 steps to market your flexible assets. From access to the energy market and AI-powered trading strategies to the right organisational fit.

subscribe today for industry blog articles, resources, and special invitations to upcoming webinars and events delivered straight to your inbox