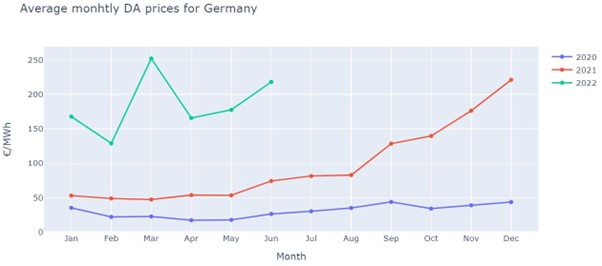

Looking back to February 2022, when Uniform pricing part 1 was published, we can only be astonished by the growing upheaval in the European energy sector. We will not attempt to list all the major events that happened in the last 6 months, but the figures speak for themselves: average day-ahead prices have increased by 230% (or 130 EUR/MWh) compared to the first 6 months of 2021.

In the context of a brutal increase in the reference (spot) price of electricity, it is only normal that the mechanism setting this price is under scrutiny. In particular, how surprising it may sound that the price of electricity is set by the marginal source of power, i.e. natural gas in most cases. Why do we price each MWh as if it was produced using gas even though most of the generation comes from other energy sources which are currently much cheaper?

As relevant as this question sounds, another way to look at things is that the MWh produced by other means of generation (wind, solar, nuclear, coal), as soon as it has been injected into the grid, is the same as one that comes out of a gas-fired power plant. Therefore, why would the owner of a wind farm accept a lower price than the one paid to the owner of the gas power plant? Let's dig deeper into the matter!

Bidding strategies in a pay-as-bid auction

In the scenario of a pay-as-bid auction (as opposed to the current pay-as-cleared spot auction), the owner of the wind farm would bid at what it expects is the marginal cost of a gas power plant. Because he/she knows that in order to meet demand, the gas power plants will have to run, which they won’t do below their marginal price.

This is in fact a good example of the kind of strategies that market players would put in place if we were to change the pricing mechanism. Asset owners would try to guess each other’s marginal prices and bidding strategies in order to maximize their revenues. For instance, if I know that a neighboring power plant has a lower marginal cost than mine but tends to bid with high markup, I may decide to bid with a lower markup in order to increase my chances of successful bidding. Consequently, it may happen that my bid gets accepted, and my competitor’s bid is rejected even if he/she has a lower marginal price.

In other words, the first consequence of moving away from uniform pricing would be a loss of efficiency in power generation. In a pay-as-cleared auction, market participants are incentivized to bid at their marginal cost which ensures that we use the cheapest generation stack to meet the demand at any time (see details on the “merit order” in the first part of this series). Since emissions are internalized in the costs through the EU Emissions Trading System, this means among others that between two power stations with the same “fuel costs”, the less carbon-intensive one will always be activated first. In a pay-as-bid system where market participants have every reason to bid at a different price than their marginal cost (if only to recover their fixed costs), this does not hold true anymore.

The domination of big utilities

Success in a pay-as-bid system depends heavily on the forecasting and strategic bidding capabilities of a market actor. In this regard, large economies of scale can be achieved by big utilities compared to smaller players. Running a larger set of power plants also allows for more complex bidding strategies (based on the cost and capabilities of a pool of assets) and confers additional market knowledge. It is therefore likely that pay-as-bid would make it harder for small players to compete with big market actors.

This could be particularly dramatic as innovation from small players plays an important role in the transition towards a greener energy industry. A few examples are companies aggregating demand response which provides much-needed flexibility in peak hours; small actors operating batteries or hydrolyzers which can absorb the excess energy in periods of renewable overproduction; or smart home solutions which increase domestic self-consumption and thus smoothen steep evening ramps. The energy industry needs fair competition between a wide range of actors in order to achieve an efficient transition, a framework that currently seems better achieved with a pay-as-cleared day-ahead auction.

It is likely that a pay-as-bid system would increase the probability of market players gaming the system in order to artificially increase prices. In a pay-as-cleared auction, bids are supposed to reflect the marginal prices of assets which limits to some extent the prices that a generator can ask (a generator bidding way above its marginal price without justification may arise suspicion from the regulator). In pay-as-bid on the other hand, one cannot expect market players to bid at their marginal price and it is thus much more complicated to prove that a generator is bidding at artificially high prices (for instance in periods of scarcity). Furthermore, the lack of competition arising from the switch to a pay-as-bid system also increases the chances of collusion between a few big utilities. At a time when generation capacity is particularly low (think of nuclear phase-out in Germany, nuclear outages in France, cuts in natural gas supply), it seems important to limit and control the power of market actors which seems again better achieved with a pay-as-cleared system.

The current market design is certainly not perfect, and ACER published a report in April in which it identifies long-term improvement areas for EU wholesale electricity markets in general. The agency however concludes that the current market design is worth keeping. In view of the arguments above, we at enspired think that a shift towards non-uniform pricing would indeed be counterproductive. The expectations towards the energy industry are high in the coming decades: it needs to decarbonize rapidly while increasing generation to meet the electrification of processes and maintaining reliability. In this context, increased volatility, the concentration of market power, or a drop in reliability that could arise from the mistaken market change would be dramatic for the whole of Europe.