What is cross-market battery optimization?

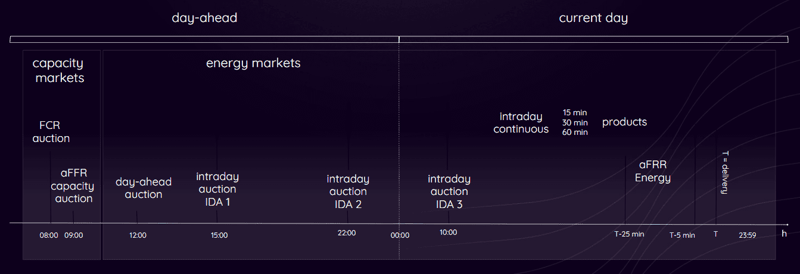

As the renewable buildout progresses and continues to put pressure on the grid, batteries emerge as a reliable provider of flexibility through on-demand energy strorage and release capabilities. Cross-market battery optimization makes strategic use of this capacity by distributing it across all relevant power markets to maximize revenues and support grid stability. How do we achieve the commercial optimum, and which factors influence revenue potential? Battery energy storage systems (BESS) can be marketed for ancillary services in FCR (Frequency Containment Reserve), aFRR (Automatic Frequency Restoration Reserve) energy, aFRR capacity, and mFRR (Manual Frequency Restoration Reserve), all of which are regulated by the TSO (Transmission System Operator).

While mFRR is currently not relevant for cross-market optimization, it is essential to additionally branch out into wholesales, also known as the spot market, which covers day-ahead, intraday, and continuous intraday auctions. These are not regulated by the TSO and do not require pre-qualifications or security of supply. Instead, they can be accessed directly through the power exchange. It is commonly observed in the market that the majority of battery storage players in Europe place their assets in ancillary services only (mostly FCR), which puts them at risk and makes them financially vulnerable. Why is this? Since FCR prices are steadily falling, and batteries act as a main balancing source for the TSOs, more and more players are entering the market, producing a cannibalization effect that calls for

- diversification to minimize risks and safeguard developing market trends

- sophisticated wholesale arbitrage to reduce amortization time

- cross-market asset optimization to benefit from revenue stacking

An ideal battery layout forms the basis of your business case; optimal dynamic allocation makes the next level. Depending on the parameters of your flexible asset, you can trade energy on different markets and benefit from certain revenue streams. Not all energy storage is the same – there are 5 parameters that impact battery optimization and potential revenues.

- Duration

Longer duration gives you the freedom to market the battery in a preferred SoC (State of Charge) range.

- Capacity

Longer battery capacity provides extended usage time without the need for frequent recharging.

- Cycles

More cycles can generate more revenue with the right parameters and portfolio setup.

- Efficiency

RTE (Round Trip Efficiency) is the amount of energy that can be stored and retrieved from the battery.

- Warranty

Manufacturer warranty terms bind you to certain specifications for battery utilization. Read more about battery system sizing and warranty terms here.

From capacity markets to energy markets

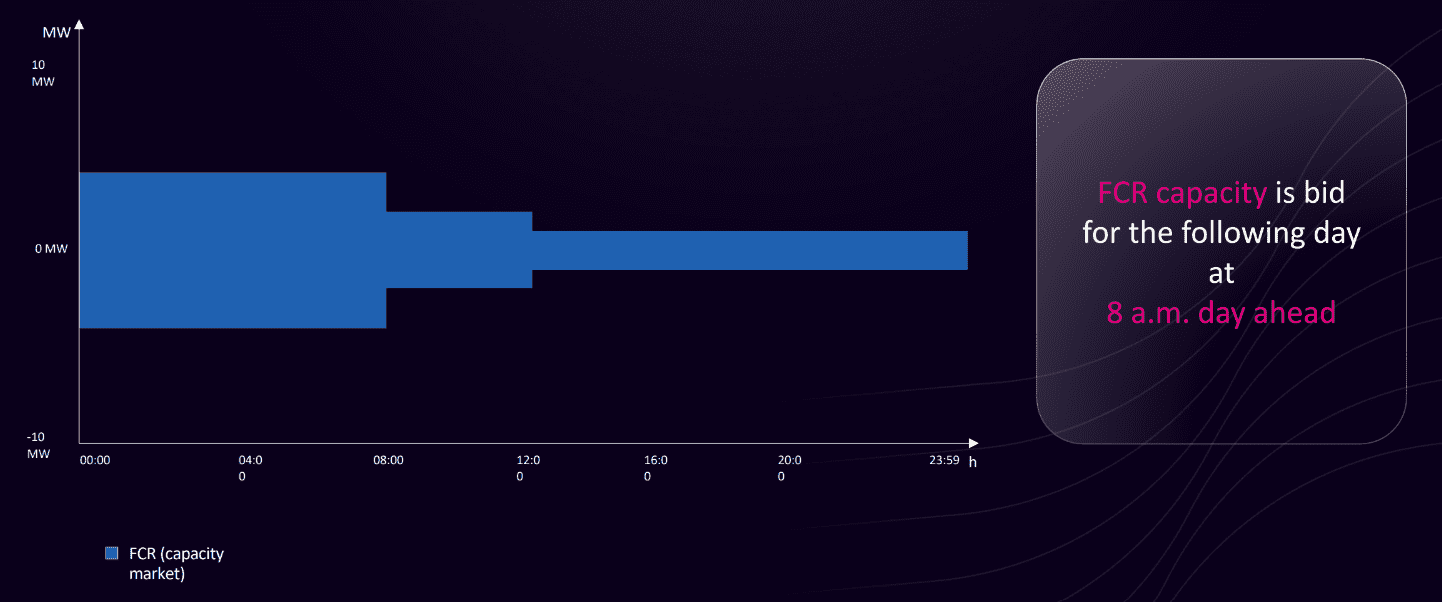

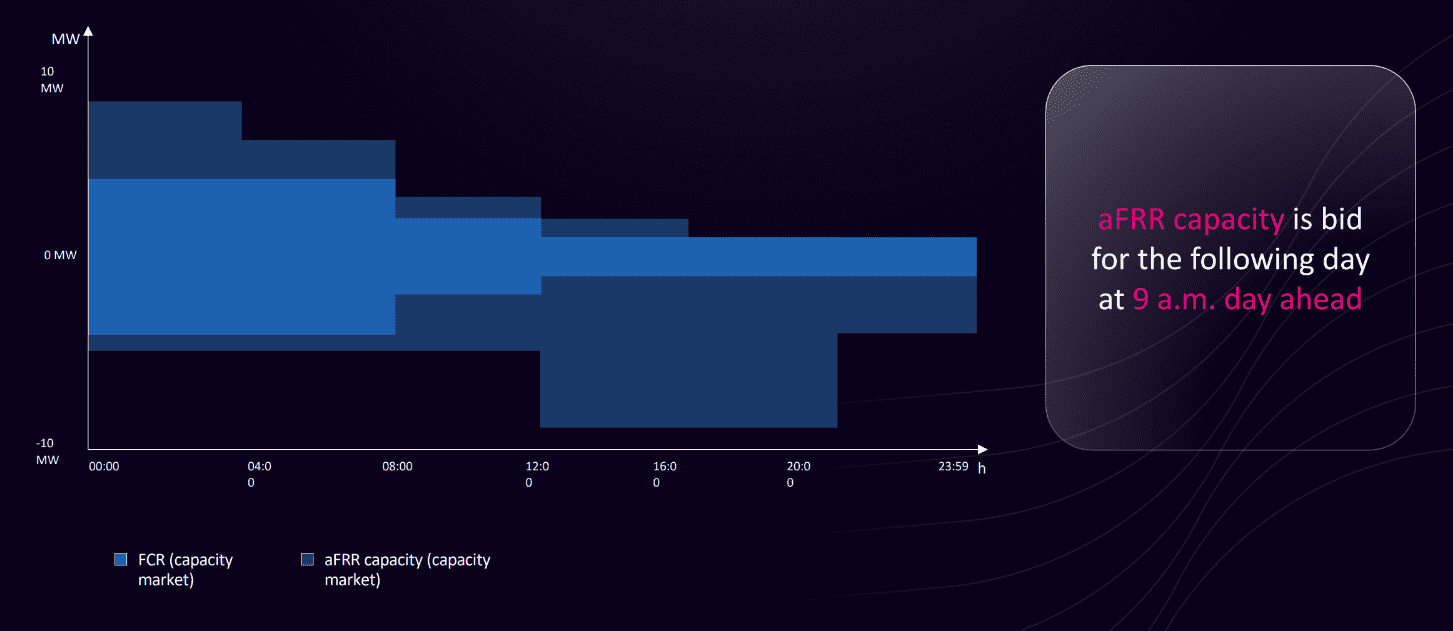

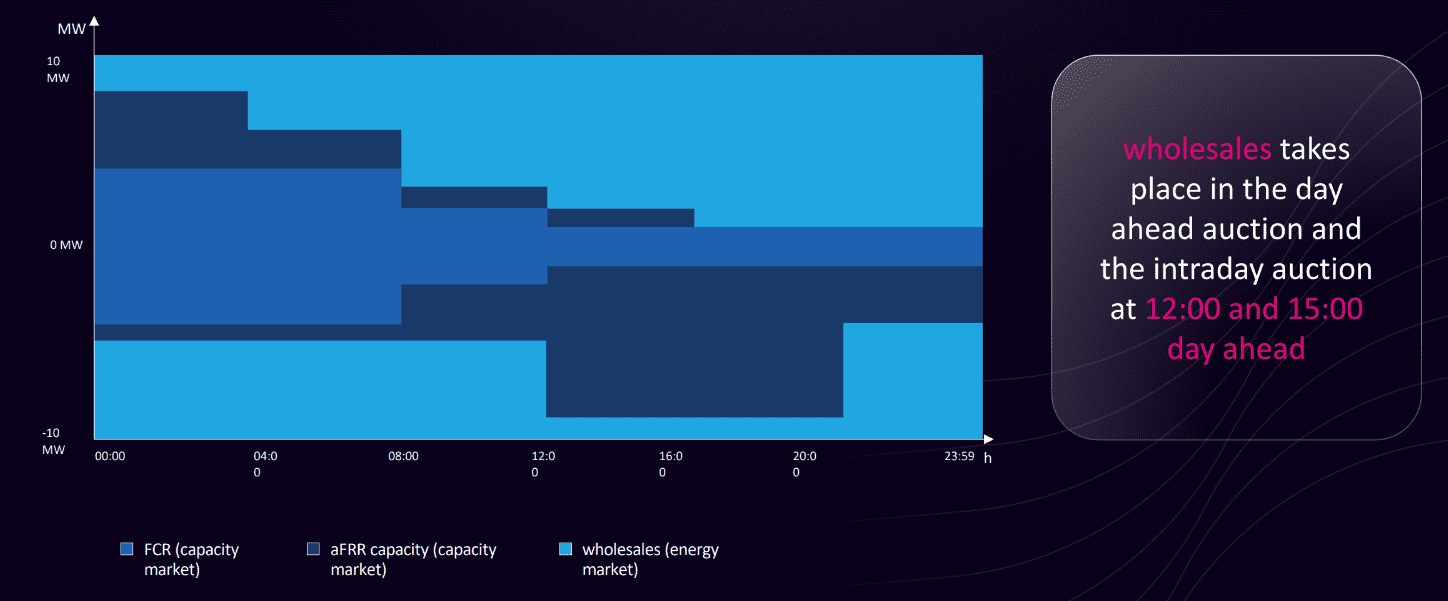

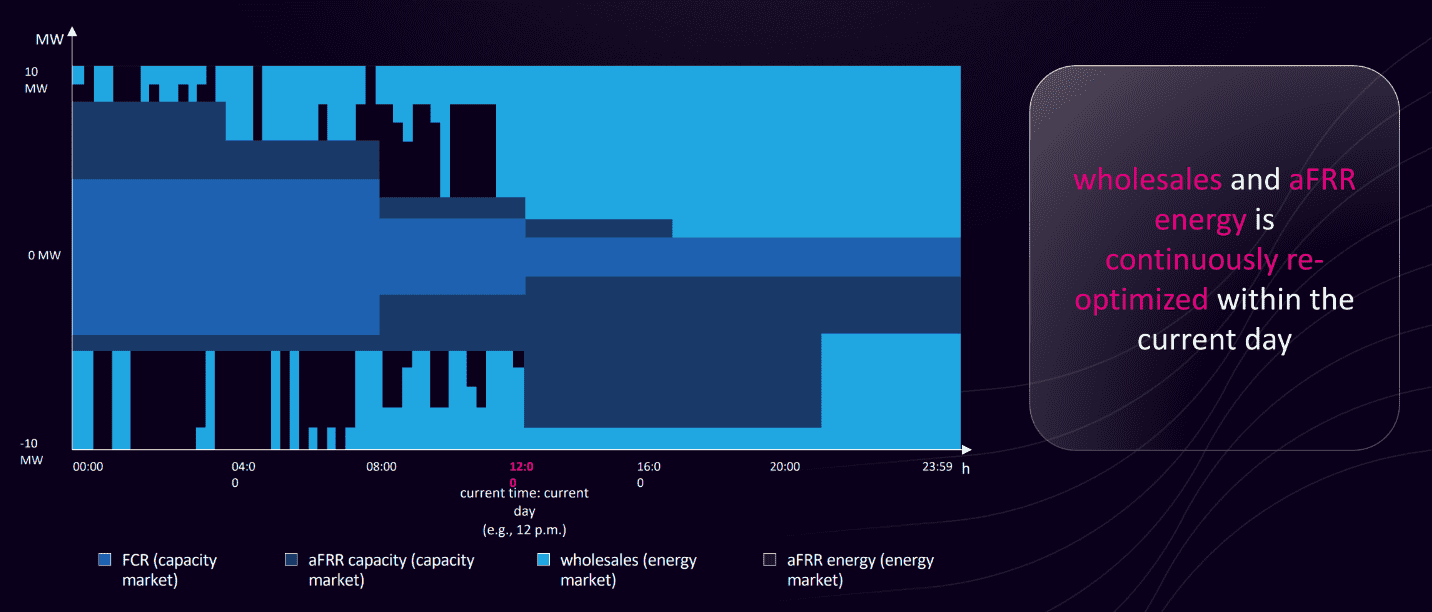

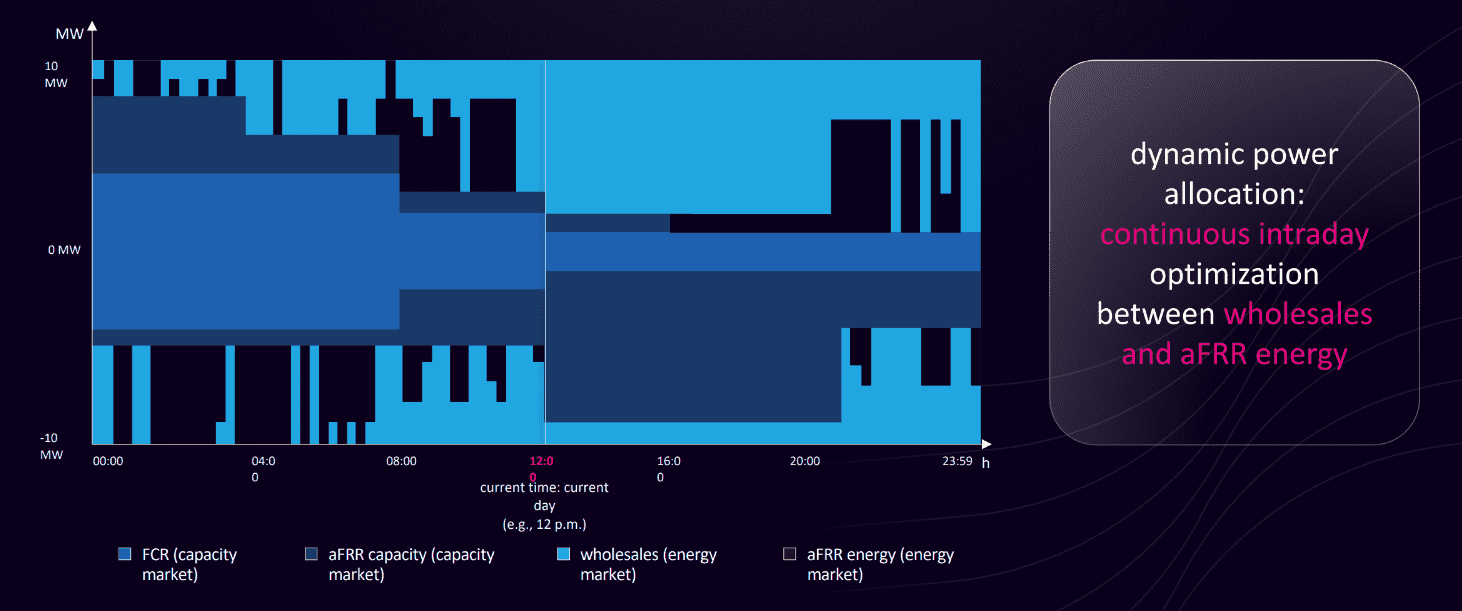

Fundamental models predict a shift from ancillary services to wholesale markets, and within wholesales, from day-ahead to continuous intraday. Cross-market optimization entails dynamic power allocation, whereby capacity is bid in the auction, and energy is optimized continuously in intraday.

Our fully automated in-house platform ensures successful market participation and the most lucrative results through:

- high-speed backtesting: enables the exploration and training runs of millions of scenarios, facilitating the determination of optimal trading behavior.

- AI-based forecasts & trading strategies: trained with millions of backtests and forecasts, the strategies take into account weather conditions, future market developments, and price expectations for the auction and continuous markets.

- capacity auction bidding: as the ultimate marketing goal is always the optimum result from the combination of all markets, the bidding strategy for the capacity markets considers expectations of future price developments in continuous trading.

- continuous optimization in the energy markets: enables second-by-second optimization in the energy markets to continuously optimize the commercial result.

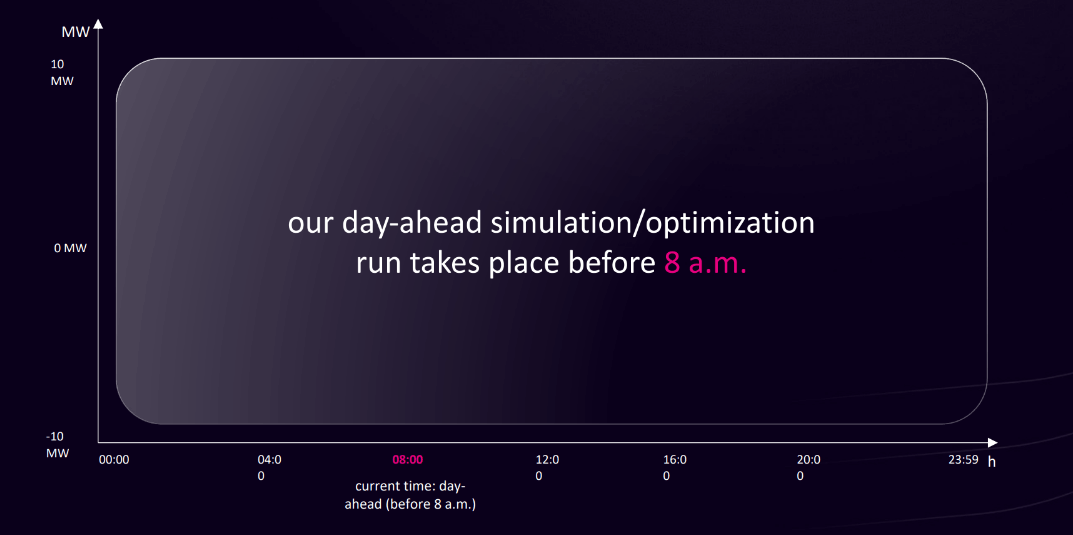

Follow the graphs below to understand the journey from cross-market capacity allocation to the optimal trading result.

Performance reference for 2023

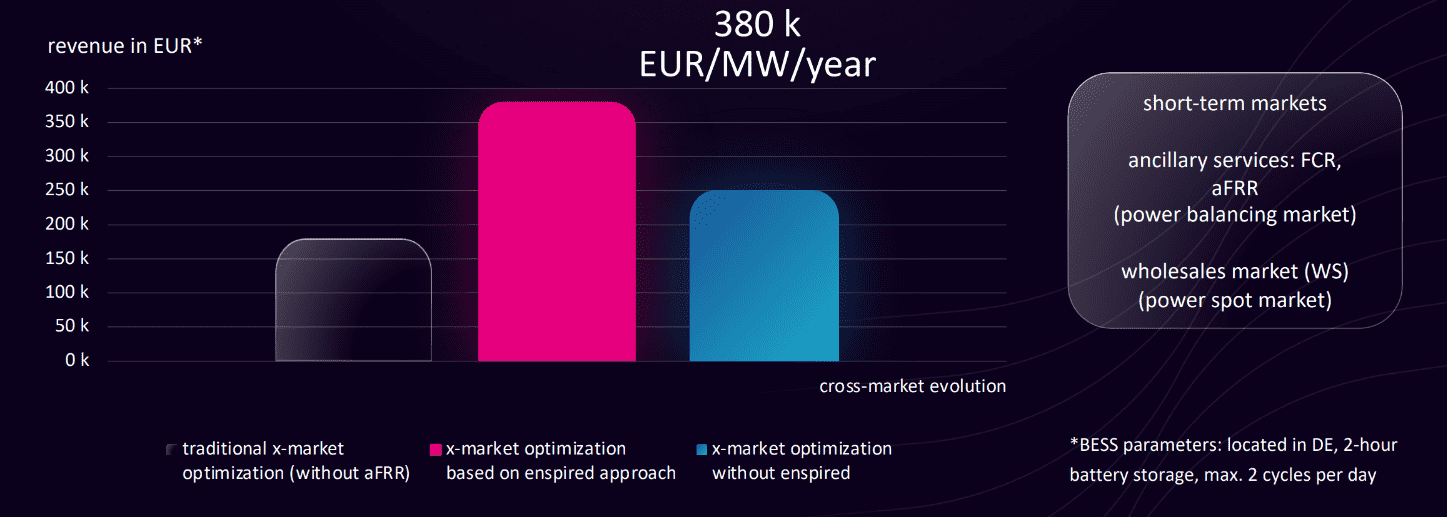

Approaches to cross-market battery optimization

Cross-market battery optimization increases your revenues by monetizing the flexibility of your assets strategically across different markets and revenue streams. From a technical perspective, there are two ways to do this. The current approach adheres to manufacturer warranty terms, maxing out the available capacity and cycles to achieve maximum revenues. This is very lucrative, but it also means that the asset will degrade according to plan (as specified in the degradation information).

What if you could achieve peak revenue levels while extending the life of your BESS? In a new approach, we are applying a degradation-informed strategy and can now prolong the operational lifespan of your assets by tailoring the optimization to your battery’s health through cell-specific dispatch profiles. Rather than simply complying with technical requirements, degradation costs are integrated into the optimization strategy. This is easier said than done as batteries have a wide range of different cell types, and these cell types behave very differently from one another. Depending on the SoC range in which a battery is cycled, its RTE and capacity retention can vary significantly. Cell-specific optimization minimizes degradation, which drives up your revenues and, by extension, profits over time. Learn more about this topic here.

Interested in leveraging cross-market optimization for your battery?

Let’s talk about your use case →