Could battery revenues in continental Europe follow similar patterns as those in Britain?

After BESS (battery energy storage system) revenues in Great Britain dropped to record lows this year, there is a growing concern in the industry about the possibility of ancillary service prices and, by extension, business cases collapsing in a similar manner across mainland Europe. Therefore, one question is frequently asked in strategy meetings with battery investors: Will BESS revenues in continental Europe follow the British trend?

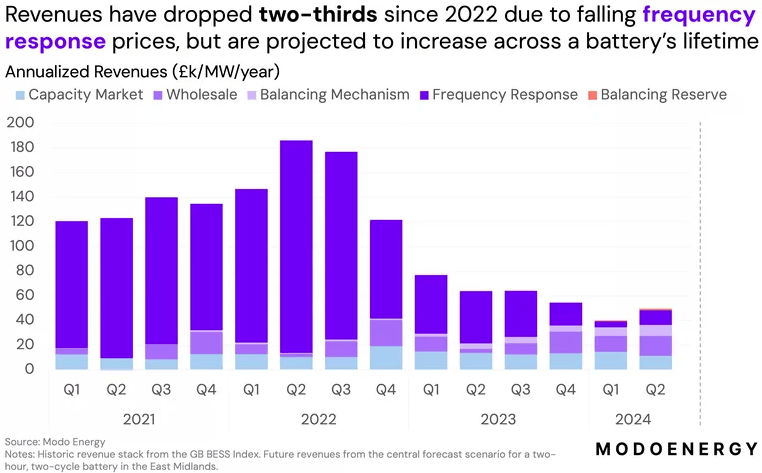

So, what happened in Britain? For a time, battery revenues were remarkably high, and the market quickly became the fastest growing in all of Europe. Then, within half a year, the market plummeted from £150k/MW/year to less than £50k/MW/year—a drop by two-thirds! Following this, battery investors are raising concerns about running a similar risk in continental Europe.

Graph 1 source: Modo Energy

Saturation of ancillary services: where did the British battery market go wrong?

As one of the first countries to fully embrace the capabilities of battery storage, Britain became a model market, and local operators did not do much wrong initially. FFR (firm frequency response) and EFR (enhanced frequency response) were launched with fast-response requirements and intended to serve as a specific revenue stream for BESS. However, both were eventually phased out and replaced by the dynamic suite (Containment DC, Moderation DM, Regulation DR), which has since become the core revenue stream.

As battery fleets grew, the supply quickly outpaced demand, putting pressure on prices in a natural progression for a market-based environment. Local battery marketers relied primarily on ancillary services to bring in revenue, but the demand for these is fundamentally regulated and can, therefore, become saturated. This is what happened in Britain. Alternative revenue streams were available for batteries, but the British design is such that it allows imbalances, while subjecting the responsible party to penalties. To mitigate any deviations from a balanced system, the Balancing Mechanism (BM) is in place to resolve issues between gate closure and real-time delivery. This allows registered BMUs (Balancing Mechanism Units) to bid or offer capacity. Batteries were not used for this purpose initially and, according to recent industry reports, are still not fully utilized. In Britain, the National Grid performs manual dispatches to correct imbalances. Ensuing skip rates (curtailed energy generation due to oversupply) limit the realized storage and revenue potential of batteries, something that does not happen on the continent.

For a short while, blending ancillary services, particularly the high products (where an asset is paid to charge), enabled artificially inflated wholesale revenue in Britain. Wholesale markets in isolation provided reasonable spreads, but the market depth was not enough to sustain high prices; thus, the frequency of high and low spikes began to diminish, eroding value. In the end, this combination of factors and heavy reliance on ancillary services led to an oversupply of BESS, and the disproportionately low demand caused the revenues of asset owners to drop.

From an optimizer perspective, the wholesale market in continental Europe offers a stable, reliable, and growing revenue stream driven by stricter balancing regimes. Most markets mandate that shortfalls and surpluses in renewable generation (deltas) be traded to preserve grid balance. This means that market depth and liquidity can grow alongside renewable penetration.

Market factors and revenue situation in continental Europe

What continental Europe did differently from Britain was the building of integrated wholesale and ancillary service markets. These benefit from an interconnection with other countries, common liquidity, granular balancing, and shared order books of the NEMOs (Nominated Electricity Market Operators), including EPEX SPOT and Nord Pool. While Britain operates on a national single market, the continent operates on a pan-European market spanning the FCR Cooperation, PICASSO*1, and MARI*2 for ancillary services, and SDAC*3 and SIDC*4 for wholesales. This interconnection enables Germany to export electricity to France, and Hungary to import electricity from Austria. Additionally, the interconnected network improves the situation with rotating masses (spinning turbines of conventional power plants) by pooling inertia (resistance to sudden imbalances) from various shared sources to make the grid more resilient to frequency deviations. Meanwhile, a physical connection between Britain and mainland Europe exists only in the form of interconnectors, which require explicit capacity bookings that make the geographical island of Great Britain an island in terms of market design as well – cut off from other players. While an integrated market design like in continental Europe does not directly drive stable revenues from BESS optimization, it enables a more flexible adaptation of optimization strategies to changing market conditions.

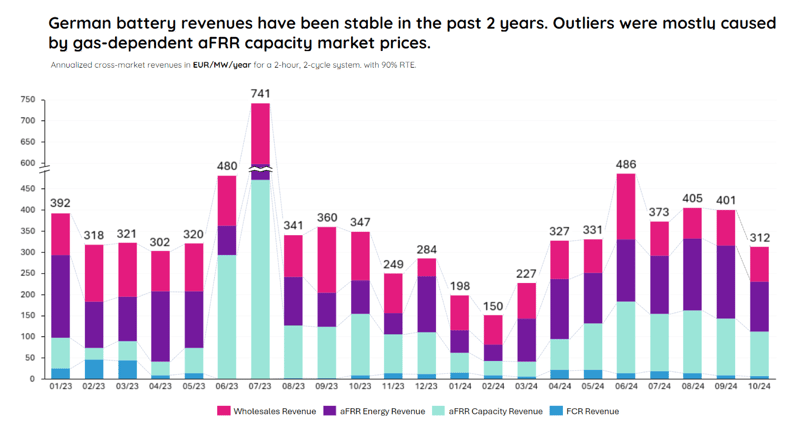

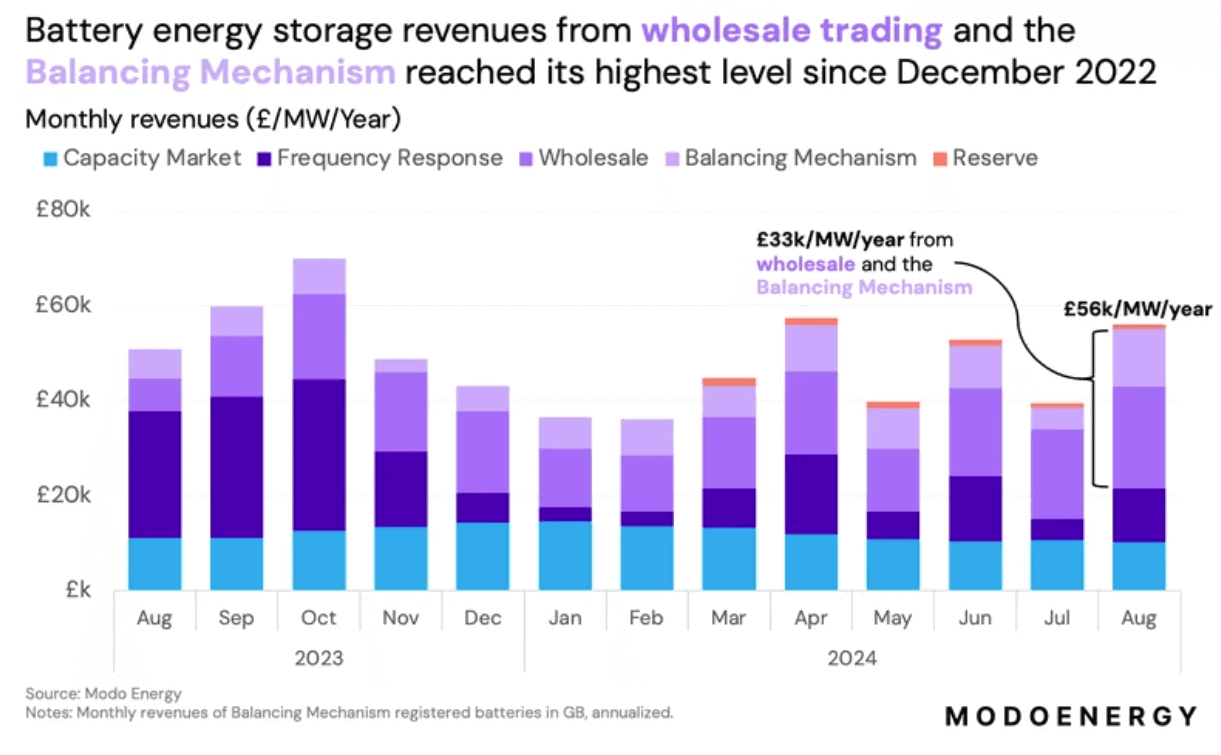

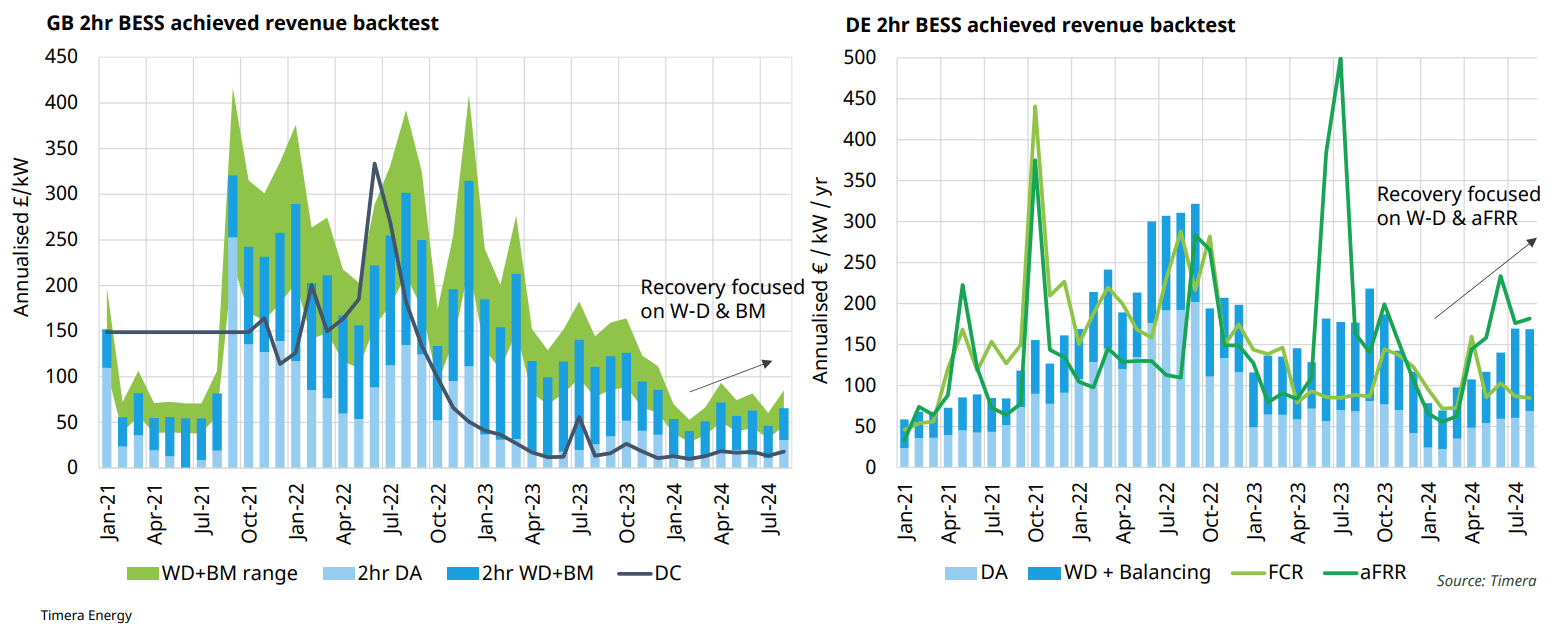

For comparison, graphs 2 and 3 detail the split of revenue streams in Germany and Britain, respectively. Germany exhibits a noticeably higher wholesale share, and the overall annualized revenue is also significantly higher, with Britain’s at the £56k/MW mark in August 2024 (equal to approx. €67k/MW at the time of writing) and Germany’s at €405k/MW for the same month. For Britain, it was the strongest performance since December 2022.

*1 PICASSO: Platform for the International Coordination of Automated Frequency Restoration and Stable System Operation (common aFRR market)

*2 MARI: Manually Activated Reserves Initiative (common mFRR market)

*3 SDAC: Single Day-ahead Coupling

*4 SIDC: Single Intraday Coupling

Graph 2 source: enspired backtest including data from EPEX SPOT and Regelleistung

Graph 3 source: Modo Energy

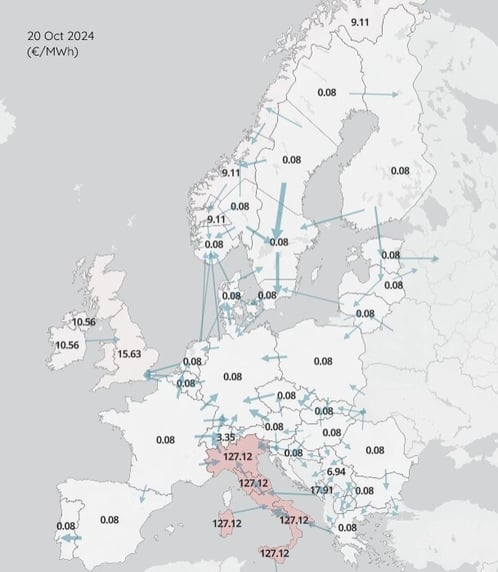

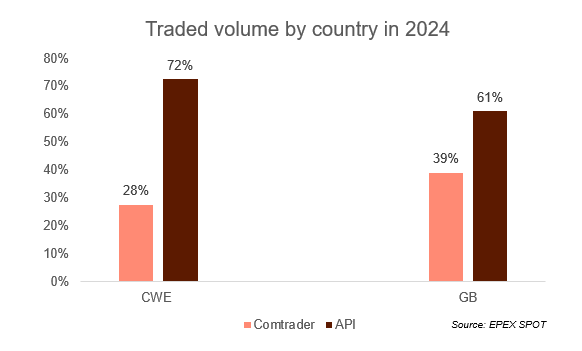

The uniform structures in continental Europe feature harmonized products, providing greater price predictability, increased efficiency, and less exposure to risk. In graph 4 below, a glimpse into day-ahead market coupling on 20 October 2024 at 11:30 am CET showed what that can mean: Almost every commercial zone from the very south of Spain to the very north of Finland had the same price. It is additionally worth noting that continental Europe exhibits a higher degree of automation in trading, with 72% of trades automated compared to 61% in Britain (see graph 5). All this boosts wholesale liquidity both in terms of market functionality and market maturity.

Graph 4 source: Montel EnAppSys

Graph 5 source: EPEX SPOT

Developments in ancillary services

Graph 6 shows improving ancillary service market conditions in Germany compared to a flat plateauing line in Britain. There are two reasons for this: DC prices in Britain combine a high (typically low priced) and low (typically positively priced) product, and since the launch of the Enduring Auction Capability in November 2023, DC and other dynamic services are exposed to negative prices pushing the average lower. In Germany, due to the slower buildout of front-of-the-meter batteries, ancillary services still partially rely on conventional power plants, while the demand for grid support increases as more renewables become active. On days with high renewable energy production, wholesale prices can drop to zero or become negative, which puts pressure on the conventional assets that provide grid services. Since they are unable to benefit from selling power, they set a high hurdle rate in the ancillary service market to recoup the shortfall.

Graph 6 source: Timera Energy

Maintaining BESS revenue stability

In the end, can it happen that battery revenues in continental Europe nosedive like they did in Britain? Given the fundamental differences in the market structure alone, it is highly improbable. As we have established, the continental European market is interconnected, coupled, and deep, whereas Britain is more isolated, de-coupled, and shallow, although it is presently showing signs of recovery in part due to improved wholesale trading opportunities. The events in Great Britain are a good learning lesson for the continent. What we can also take away from this analysis is that even if ancillary service prices in Europe dipped, the wholesale component is significant enough to sustain revenue security for battery systems.

Revenue transparency for battery systems is an issue when benchmarking your business case?

This new index will help.

Capture the revenue stability in continental Europe with your asset.

Let's optimize your battery project.